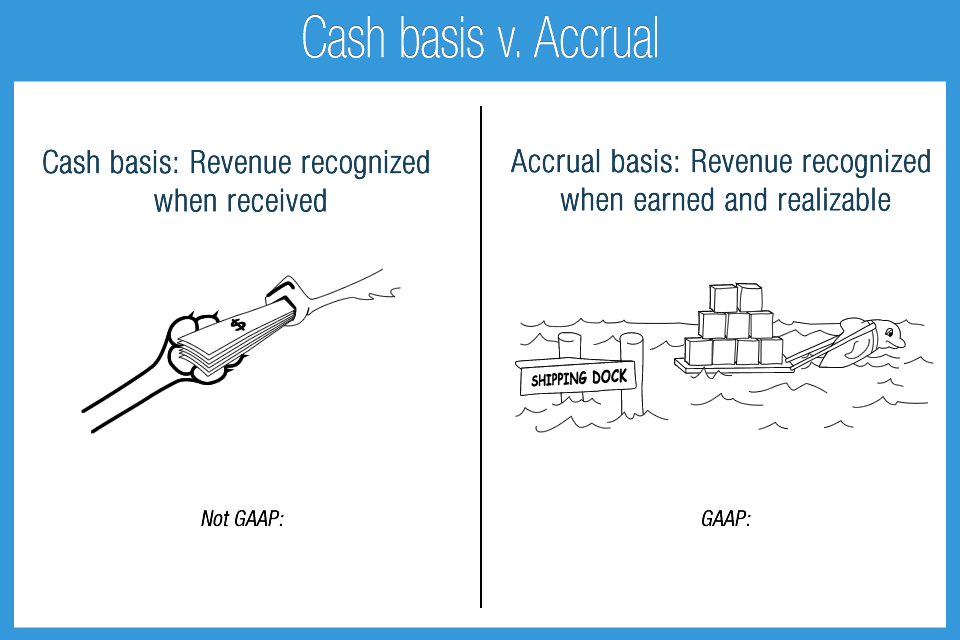

Cash basis v. Accrual: The cash basis method of accounting recognizes transactions only when cash or equivalents have been exchanged. Accrual basis follows the matching principle and records (recognizes) transactions as they occur

- Only accrual basis accounting is an acceptable method under Generally Accepted Accounting Principles US

- Cash basis records revenue and expenses only when cash or equivalents have been exchanged

- Accrual basis records revenue when earned and realizable and expenses as incurred, even if cash has not been paid

AccountingPlay Apps

Learn Accounting Faster and Easier

Learn financial accounting, debits & credits, and business tax easier with flashcards, mobile apps, and games. Learn accounting anytime and anywhere. AccountingPlay will help you learn in a fast and fun way. Available on iOS and Android

Premium Courses

One Time Payment. Lifetime Access.

Learn more comprehensively about debits and credits, financial accounting, Excel fundamentals, business tax prep & plan, CPA tax prep, and how to start and grow your business right. Get access to all of our books, spreadsheets, academic papers, cheat sheet, audio vault, videos, and more.

Recommended Tools

One of your top priorities as a small business owner is keeping a close eye on the money you bring in and pay out, which is why it’s critical to have the right accounting software. You need a program that helps you accomplish your daily accounting tasks. Here are our best picks for tools we recommend and use.