- Accounting Topic

- Financial Ratios Topic

Business Types, United States

Disclaimer: This information is for educational purposes only and not to be used as tax or legal advice. Tax law and accounting protocol are constantly changing.

Business Types, United States

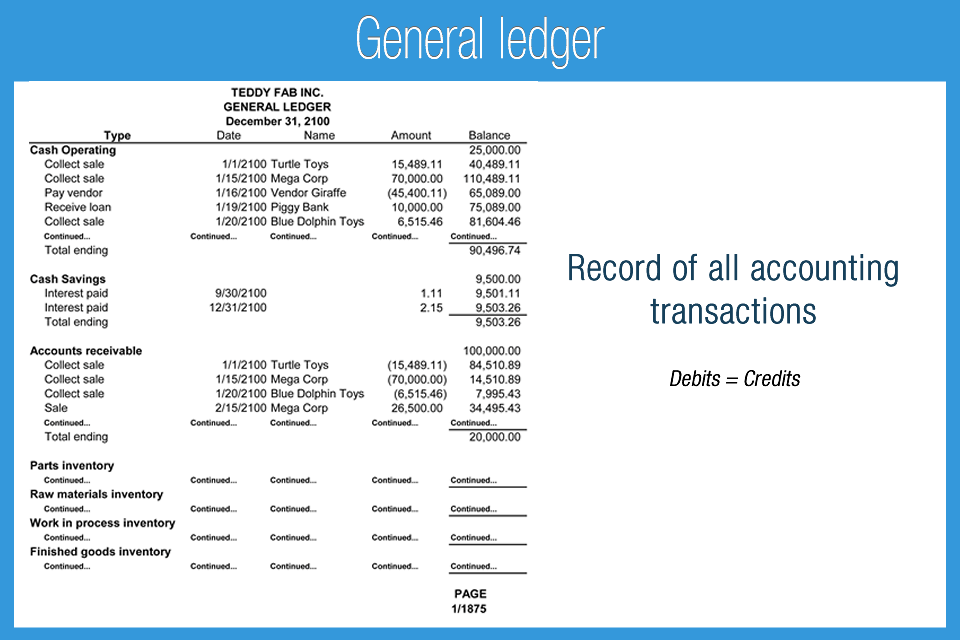

The legal structure of a business is referred to as the business entity. The entity choice has a significant impact on the taxes the owner(s) pay and tax returns that they will need to file. Accounting for different small business entities is similar in that Generally Accepted Accounting Principles (GAAP) will provide guidance so that the business will be on the accrual method, reconcile cash, and maintain a general ledger. Different structures will; however, have distinct differences in accounting for equity. The business entity choice is mix between legal and tax benefits while weighing compliance costs. Most legal benefits and operating rules are governed by the state, while taxation rules will be governed at the federal level.

Liability Protection and Piercing the Corporate Veil

Different business structures offer different liability protection to owners, depending on the laws of different states. In the case of sole proprietorships and general partnerships, no liability protection is granted under the law. Limited liability partnerships, limited liability companies, and corporations provide liability protection to owners, but not in all circumstances. These entities do little to protect individual owners who are negligent (not taking proper care) or break the law. Self-employed surgeons, for example, cannot rely on a corporation to protect their personal assets if they should happen to kill a patient while performing surgery drunk after a three day party binge on prescription medication stolen from the ER and shared at a club. In such a scenario, no protection is provided for the individual doctor, but shareholders would not be liable. Regardless of the business entity choice, insurance can be used to protect owners against professional liability.

Holding corporate and limited liability company owners personally liable for wrongful acts is referred to as piercing the corporate veil. The courts could hold the perpetrators of crimes be held personally liable regardless of the business structure in place. There are other action that owners can do that may effectively erode any protections under the law. If an owner does not follow the required entity protocols by co-mingling funds (combining business and personal accounts), does not pay state fees, or has fraudulent accounting, the courts may ignore the structure for legal purposes. Individual investor owners, chief executive officers, and chief financial officers may be held more responsible for corporate negligence.

Sole Proprietorship

The sole proprietorship is the most common entity structure in the United States and can be owned only by one person. A sole proprietorship has one owner that is personally liable for all business debts and lawsuits. To become a sole proprietor, an individual need only start operating as a business: Earning money and having expenses. By default, the sole proprietorship operates under an individual name; however, a business name may be established, known as a “DBA” which stands for Doing Business As. Income taxes are computed at the individual level, but property and local taxes may still be required. The business may have employees and is responsible for related taxes. Typical sole proprietorships are business that do not require outside investors and are small in nature such as: Consulting services, lawn care, and small dental practices.

Advantages

Sole proprietorships are low cost and require little to no setup. Some cities require registration and business property tax if the sole proprietor has significant property assets. Because it is not a separate entity for tax and legal purposes, business activity is reported on an individual tax return. Although not a best practice, business and personal funds may be co-mingled. Taxing authorities will likely not require double entry accounting due to the cost and complexity for a very small business.

Disadvantages

Owners of sole proprietorships have unlimited personal liability for any actions committed by the owner or employees in the course of work. Should an owner or employee commit harm accidentally or intentionally, all of the owner’s assets are subject to seizure in the case of a lawsuit. Sole proprietors can obtain insurance to protect the owner to combat this disadvantage. Financing must either be funded by the individual or loan, as the structure does not allow for outside investment. There is no continuity of life for the sole proprietor ship: For academic purposes the Sole Proprietorship dies when the owner dies.

Accounting

Accounting for a sole proprietorship under GAAP requires double-entry, accrual based accounting for purposes of financial statements. Relatively few sole proprietorships; however, issue GAAP statements unless they are required to obtain a loan. Because the sole proprietorship and individual are one in the same, there is no stock, shareholders, or dividends. Owners receive money from the business in the form of a “Draw” which is a distribution of capital. Best practices dictate that draws come in the form of cash withdrawals. If an owner spends business funds for personal use, the accountant will classify the transaction as a draw which is a reduction of equity. Regardless of whether the owner takes a draw or not, the owner is taxed on the overall profit or loss.

Summary

Sole proprietorships are cost effective and practical for many small businesses that do not need outside investors. Owners may receive loans to finance operations, but not grant ownership in the company to anyone unless they first change the structure. Because of the lack of continuity in ownership, loans are generally guaranteed against the business and the owner personally. Businesses may start as sole proprietorships and then change the entity structure at a later date to facilitate investment and limited liability.

- The most common business structure

- Owners have unlimited personal liability for their individual and employee actions

- No outside investment is permitted, but loans are

- Accounting requirements for tax purposes are generally more simple than other entities

- Tax is based on the profit or loss of the business on an individual tax return

- Business dies when the owner dies (no continuity)

Flow-through Entities and Corporate Double Taxation

Partnerships, limited partnerships, and limited liability companies are referred to as flow-through entities for tax purposes. For tax and accounting, all three entities are similar to partnerships. Flow-through entities to not pay federal or state income tax and therefore “flow” income and loss activity to owners. Owners then report income and deductions on a tax return as an individual or another business entity. There may be state fees and tax for operation, but they are relatively smaller and different from individual and corporate tax. The owner of a partnership, limited partnership, or limited liability company flow-through can be an individual, another partnership structure, corporation, and certain trusts. Some entities, such as trusts, may be a hybrid between flowing out income to beneficiaries and paying tax at the trust level.

Regular corporations (C-Corps) are taxed on profits at the corporate level and are therefore not flow-through entities. Once a corporation has paid tax on profits, dividends may be paid to shareholders (owners of the corporation). Dividends are considered income to shareholders that is most likely subject to tax (technical exceptions apply). Corporate profits are therefore subject to double taxation because there is tax at both the corporate and shareholder level.

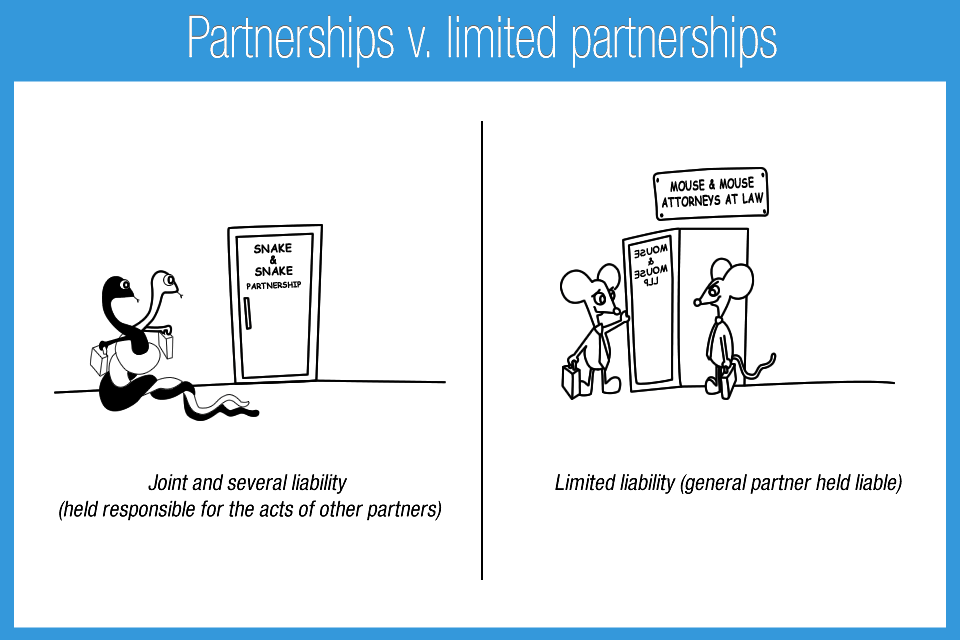

General Partnership

The general partnership entity structure is comprised of two or more owners (partners). Ownership of a partnership’s income, loss, and capital is represented as a percentage or units which calculate to an ownership percentage. No stock is issued. A partnership is not a separate entity from the owners and partners are therefore personally liable for all business debts and lawsuits. To become a partnership, two or more individuals need only start operating as a business: Earning money, creating products, and having expenses. The partnership establishes a business name by filing documents with the local government. The profit and losses for tax purposes are reported on (flow to) the partner’s tax return. Partners can be individuals or business entities such as a corporation or limited liability company. The entity may have employees. Typical general partnerships are small in nature and may be for: Property ownership, consulting services, and two or more individuals operating informally.

Advantages

Partnerships can be setup informally without additional legal or state fees. Partnerships allow for multiple owners and other outside investment. The ownership structure is very flexible and can allow for the division of profit, losses, capital, and also compensate partners unevenly. There is no tax on the federal level, but a separate tax return must filed. Similar to draws in a sole proprietorship, partners take distributions. Partners may receive “guaranteed wages” which are similar to an employee receiving compensation, but without taxes being withheld. Guaranteed wages are generally paid to ensure certain partners are compensated, regardless of whether the partnership has a profit or loss. If properly setup, partners may be able to take unreimbursed partnership expenses on their individual return. Because partnerships are a flow-through entity and do not pay income tax at the partnership level, double taxation does not occur.

Disadvantages

Partners in partnerships have unlimited personal liability for any actions committed by the owner or employees in the course of work. This means that if an owner or employee commits harm accidentally or intentionally, every partner may lose personal case of a lawsuit settlement. Partnerships can obtain insurance to protect owners to combat this disadvantage. Most businesses with more than one owner will pay the additional state fees in order to have a flow-through entity that offers some limited liability such as a Limited Partnership (LP) or a Limited Liability Company (LLC). Due to the flow-through nature of partnerships, taxation and accounting can become particularly complex: Different income and deduction types must be segregated for tax purposes, both the entity and partners have basis calculations that must be maintained, and along with several accounting requirements.

Accounting

Accounting for partnerships under GAAP requires double-entry, accrual based accounting for purposes of financial statements. The ownership is represented as capital. Withdrawals of capital are considered distributions and dividends do not exist (only in corporations). Because certain income and expenses are required to be stated on the owner’s tax return, there may be a need to maintain accounts differently for GAAP and tax purposes. Because partnership ownership can have different percentages for profit, loss, and capital, there may a subset of recordkeeping required.

Summary

General partnerships allow for outside investment and flow-through taxation. Partnership operations sets the precedent for other entities that operate similarly such as limited partnerships and lmited liability companies.

- Default business structure when two or more people (or entities) operate

- Owners have unlimited personal liability for individual and employee actions

- Outside investment is permitted

- Potentially complex ownership structure allows different allocations of profit, loss, and capital

- Tax is based on income and expense allocations reported on the owner’s return

- Partnerships are referred to as flow-through entities for tax purposes

Limited Partnership (LP)

Limited partnerships (LPs) operate in the same way as partnerships (see partnerships) but offer some liability protection for owners. Depending on the structure and specific legal rules around it, general partners of the partnership may still have liability for certain acts. LP structures are often formed because it is the only structure which provides limited liability protection for certain professional services groups.

- Greater liability protection than a general partnership

- Similar tax and accounting rules as a general partnership

- Shares same general financial advantages of a general partnership

Limited Liability Company (LLC)

Limited liability companies (LLCs) are typically structured and operated as partnerships. Certain states, however, will allow individuals to operate as sole member LLCs. Generally the LLC structure provides for the greatest liability protection, flexibility of investment, and ownership structure of all the flow-through entities. Income taxation occurs on the individual level and is therefore referred to as a disregarded entity. While LLCs offer liability protection, the owners and employees can still be liable for certain actions (see piercing the corporate veil).

- Generally the best liability protection for a flow-through entity

- Shares same general financial advantages of a general partnership

- Similar tax and accounting rules as a general partnership

Sole Member LLCs (SMLLCs)

Sole member limited liability companies provide a single owner similar legal protection as a regular LLC, depending on the state of operation. The structure is referred to as a disregarded entity because tax reporting is on an individual federal tax return. While sole member LLCs offer liability protection, the owner and employees can still be liable for certain actions (see piercing the corporate veil).

- Similar legal protection as an LLC

- One owner

- Income reported on an individual tax return

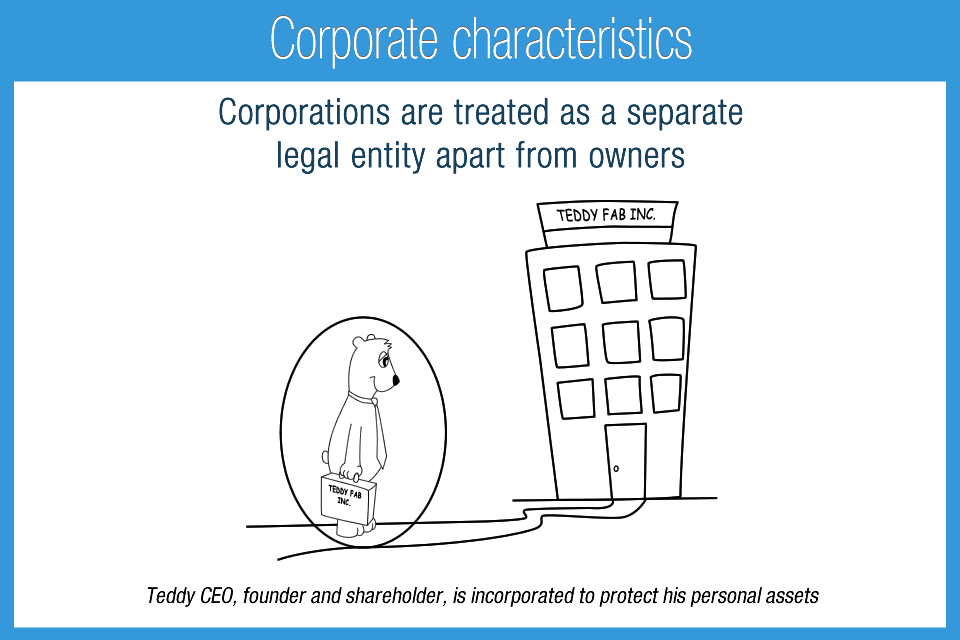

Corporation (C-Corporation)

The corporation is a business entity that is legally separate from owners, referred to as shareholders. Taxation is also separate and occurs on the corporate level. A corporation is a separate entity and the owners are not personally liable for business debts and lawsuits. While the corporate structure provides liability protection, owners and employees can still be liable for certain actions (see piercing the corporate veil). Because a corporation is separate from an individual, it can operate in perpetuity (forever). Corporations are an effective structure for outside investors. Company ownership is in the form of corporate stock or shares. Several different share types exist depending on the needs and size of a corporation. Owners can receive cash from the corporation in the form of dividends after the corporation has paid tax on any profits.

Advantages

Corporations are designed to facilitate investment and live in perpetuity. Non-employee investors can own a fraction of the corporation without the concern of personal liability. Shareholders can be paid out profits via dividends or invest for potential capital appreciation. Capital appreciation refers to when stock purchased in a company increases in value over time. Stock gains or losses are unrealized until sold or become worthless. Large corporate stock is traded daily and the value of the stock is easily determined and realized with a sale. Because publically traded stocks are easy to buy and sell (liquid), investors may be more comfortable investing in stocks versus other types of business structures.

Disadvantages

The primary disadvantages to the corporate structure are double taxation and other compliance costs. A corporation is subject to income tax on profits. Dividends must be paid in order to transfer cash to shareholders are taxable. The combined tax on corporate income and dividends is referred to as double taxation. Other associated costs due to regulatory requirements. Owner employees must be compensated through payroll, which adds to the cost and complexity of the structure. To mitigate double taxation a company may actively perform tax planning which requires current accounting records and additional professional fees.

Accounting

Accounting for corporations under GAAP requires double-entry, accrual based accounting for financial statements. Stock is issued in the equity section of the balance sheet and different types of stock are outlined in the statement of shareholders’ equity. Because corporations are a taxable entity there may exist significant differences in GAAP income and taxable income which are accounted for with highly technical methodologies (deferred taxes). Payments to non-employee shareholders are in the form of dividends which is a reduction of retained earnings. An owner may not simply withdraw capital as is the case with partnership and sole proprietorship structures.

Share Types and Stock Ownership

Stock in a corporation represents ownership and different rights to a corporation. Different types of stocks may be issued that pay different dividends or have different voting rights. Preferred stockholders may have preferential treatment for dividends compared to common stock holders. Corporations also have complex financing capacities such as bond issuances, incentives with stock warrants, appreciation rights, and other methods. Corporations may also issue stock options (right to company stock at a future date) to employees as a form of compensation. A company may repurchase stock on the open market, which would then become treasury stock. Stock owners may sell shares on public or private markets.

Corporate Governance

Corporations are owned by shareholders who have voting power to elect directors on the company board. The board and members of the company are required to protect shareholder interests. The board of directors are responsible for hiring the chief executive officer (CEO) who is generally in charge of the entire business. The board decides on dividend payments and stock splits. Larger and publicly traded corporations (companies listed on stock exchanges) must follow strict governing protocols which include a board of directors, audited financial statements and financial controls.

Summary

Corporations are generally the best business structure to raise capital (money) and provide limited liability to shareholders, but have disadvantages with double taxation. Non-employee shareholders realize money from investments in the form of dividends and stock sales. Many businesses are required to be corporations depending on the business type and financing. Highly regulated, corporations can have many complex tax, accounting, and regulatory compliance rules to follow.

- Most common structure for large scale investment

- Provides shareholder liability protection

- Corporate income is taxed at the corporate level and dividends are taxed at the shareholder level (double taxation)

- Employees are generally compensated through wages

- Dividends may be paid to shareholders which reduce retained earnings

Subchapter S Corporations (S-Corps)

S-corporations (S-Corps) are a flow-through corporate structure and are not taxed at the entity level (unless a voluntary election is made). The structure has similar legal protection that a regular C-corporation provides. The primary reason S-Corps are chosen is to reduce taxes on the individual return level. While the law can change, there have been provisions which allow S-Corp shareholders treat some money received from the S-corporation as taxed differently than ordinary self-employment income. There are several laws regulating the tax benefits of S-Corps and significant restrictions on share types, ownership nationality, and division of profits. S-Corps can be a powerful tax planning tool but may have other distinct disadvantages when seeking investment or dividing equity.

Other Business and Not For Profit Structures

There exist several other structures in which businesses may operate and receive money under specific circumstances. Trusts can own business assets and have hybrid structures of flow-through qualities and tax at the trust level. Benefit corporations (B-Corps) are structures designed to provide benefits to more than just regular shareholders. Cooperatives can allow for different forms of economic cooperation. There are also not for profit structures such that also have business components. While sole proprietorships, partnership structures (including LLCs) and corporations make up the vast majority of businesses, there are other structures which exist for specific purposes such as: Transfer of wealth, charity, and community benefit.

Conclusion: Business Types

There are several business types with various advantages and disadvantages. There is only a correct business type if that is a type required under law. Most decisions are driven by liability protection, need for outside investment, and tax planning. Businesses regularly start with simple structures and then adapt with the changing needs of the business. The decision will be unique to the business type and needs of the owner(s) as well as other stakeholders.

AccountingPlay Apps

Learn Accounting Faster and Easier

Learn financial accounting, debits & credits, and business tax easier with flashcards, mobile apps, and games. Learn accounting anytime and anywhere. AccountingPlay will help you learn in a fast and fun way. Available on iOS and Android

Premium Courses

One Time Payment. Lifetime Access.

Learn more comprehensive about debits and credits, financial accounting, excel fundamentals, business tax prep & plan, CPA tax prep, and how to start and grow your business right. Get access to all of our books, spreadsheets, academic papers, cheat sheet, audio vault, videos, and more.

Recommended Tools

One of your top priorities as a small business owner is keeping a close eye on the money you bring in and pay out, which is why it’s critical to have the right accounting software. You need a program that helps you accomplish your daily accounting tasks. Here are our best picks for tools we recommend and use