- Accounting Topic

- Financial Ratios Topic

Accounting Methods

Accounting Methods

Very small businesses often use a single-entry system to record cash earned when received and expenses when they are paid. A traveling massage business named “Magic Fingers” for example, may choose to record all cash received from clients as revenue and cash paid for things like massage oil as expenses. At the end of the year Magic Fingers will add up all revenue items for cash received and sum expenses into accounts like travel and supplies. From there, Magic Fingers will create a basic income statement (profit and loss statement) where it will take revenue minus expenses to arrive at a profit or loss in order to see how money is being earned. This information will be used to make business decisions and prepare tax filings at year end. Rules for recording these transactions may be governed by authorities such as the Internal Revenue Service, the tax collection agency for the United States. Generally accepted accounting principles governed by various self-regulated governing bodies do not allow single-entry systems.

Academic and business accounting will generally be performed using a double entry system. The double entry system requires that every transaction affects two accounts (classifications). For example, say a business deposits $1,000 in the checking account. To record this event the cash account increases $1,000. Now the accountant must decide on how to classify the other side of the transaction which will help answer: Where did the cash come from? This $1,000 could have been a transfer of cash, a loan received, an investment received, revenue earned for providing goods and services, refund from returning something to the store, and any number of other things. In this example, the $1,000 came from a loan (liability). Therefore, the accountant will manually record or use accounting software to both increase cash (assets) for $1,000 and increase notes payable (liabilities) for $1,000.

The double entry system creates checks and balances to ensure that all transactions are recorded. “Gooder Consulting” business for example, might have hundreds of revenue transactions which increased cash. Cash also decreased with expenses when Gooder paid for travel and office expenses. At the end of the accounting time period (usually every 3 months or a year) the accountant will have recorded each transaction against cash and the appropriate revenue or expense account. Ending cash in this example will need to match the bank statement or bank reconciliation if there are outstanding checks and deposits. The summary of all transactions will be recorded into the final balance sheet in which both sides of the financial statement must equal each other or “balance.” This process of balancing ensures that all cash transactions have been recorded, but does not necessarily guarantee accuracy.

- In double entry accounting every transactions affects at least two accounts

- Accounting records must balance on the balance sheet

Cash Basis Accounting

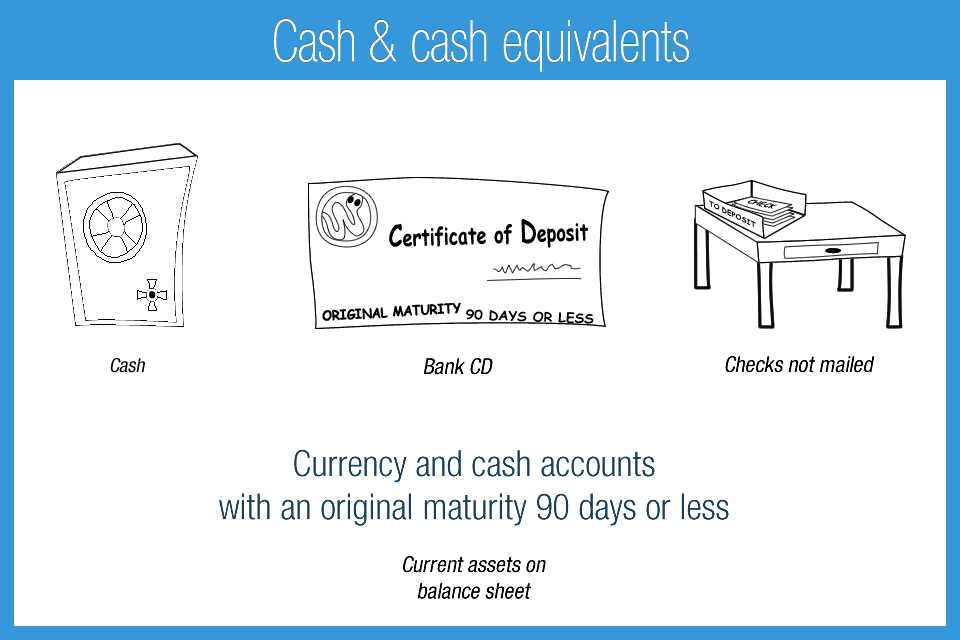

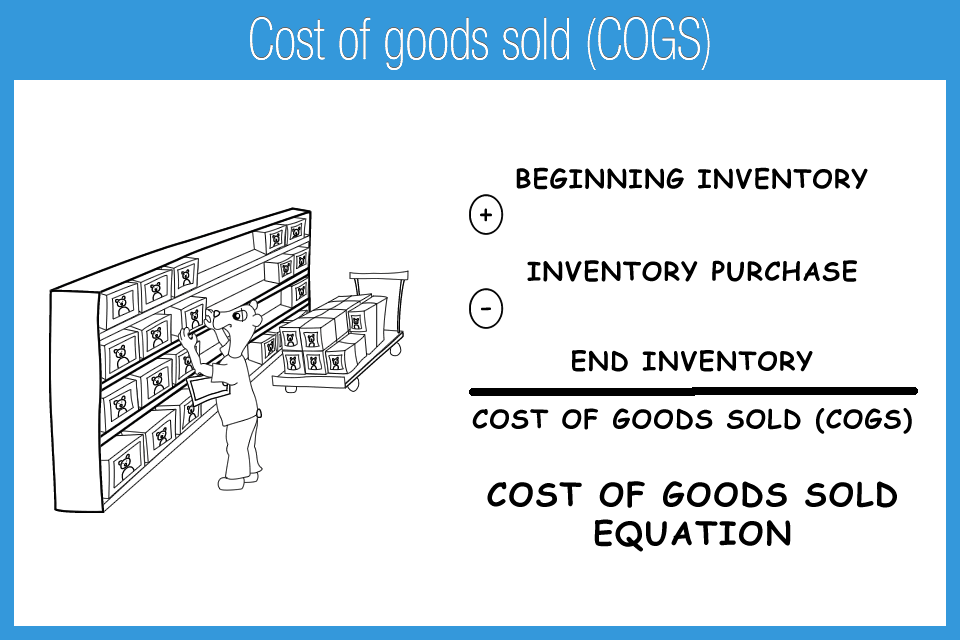

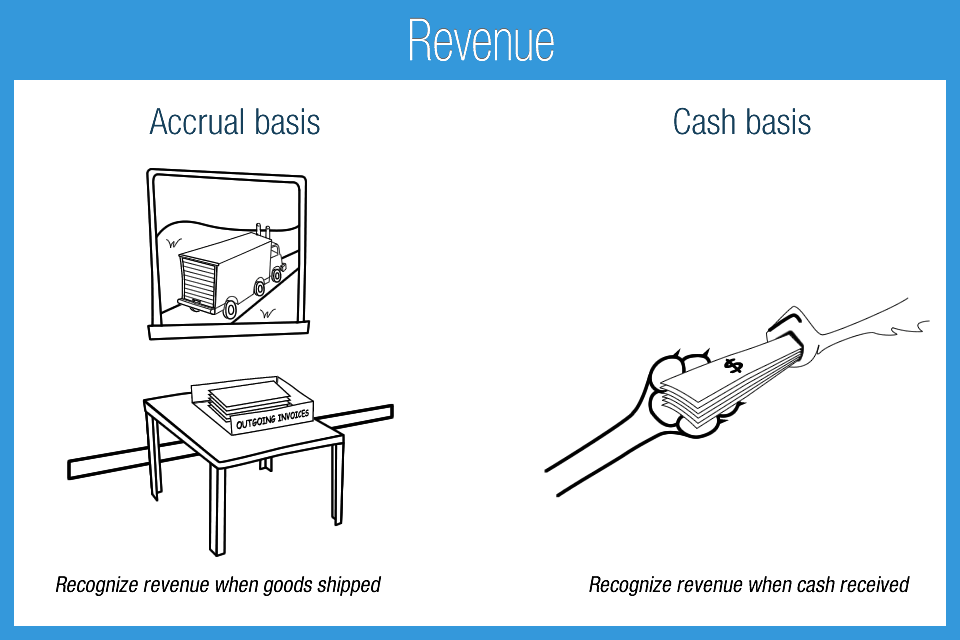

Cash basis accounting uses the flow of cash to determine when to recognize transactions on the accounting record. Revenue earned for services will be recorded when cash is received (as a transfer or check) and expenses recorded when paid out using cash or credit. The system is still double entry as the accountant uses uses two entries for each transaction so the record balances. Business such as a convenience store or factory use inventory and will record inventory purchases to assets until they are sold. Only when inventory is there an expense items, which is referred to as cost of goods sold.

The major problem with cash basis accounting is that it does not take into account assets and liabilities (debts) that the business maybe accumulating. “Gooder Consulting” for example could have $50,000 in amounts billed to clients in December that will not collect until January. Under the cash basis the expenses for travel and employees has been deducted for December, but the revenue will only be recorded in the next year when received. The income is therefore not matching with the expenses in the same accounting period, in this case December.

Under cash accounting a business may accumulate debts that are not reflected as expenses in the proper period. “Shady Manufacturing” for example does not pay $75,000 cash for employees, contractors, electricity, and supplies during the month of December. Under the cash basis Shady would therefore not be required to record these expenses and may appear more profitable in December. Had Shady actually paid out the cash the expenses would need to be recorded. Because cash basis accounting does not match revenue and expenses well, it is not permitted under Generally Accepted Accounting Principles in the United States (US-GAAP).

- Cash basis accounting is not permitted under US-GAAP

- Revenue is recognized when received and expense is recognized when paid

Accrual Basis Accounting and the Matching Principle

Accrual basis accounting is the accounting based upon Generally Accepted Accounting Principles (GAAP). This system is double entry and matches revenues and expenses during the proper period. “Gooder Consulting” for example could have $50,000 in amounts billed to clients in December that will not collect until January. Under the accrual basis of accounting, Gooder would record $50,000 of revenue because the amount was earned and realizable. It was earned because services were performed to satisfaction and realizable because the amounts were already billed to the client. The $50,000 is recorded in revenue and an asset account, accounts receivable (amounts owed to company for services in this case). Since the revenue is recorded in December, the expenses for this same time period also match the revenue earned.

Accrual accounting takes into consideration liabilities that a company is increasing during the accounting period. “Shady Manufacturing” for example does not pay $75,000 cash for employees, contractors, electricity, and supplies during the month of December. Under the accrual basis of accounting, Shady would record $75,000 of expense and $75,000 of liabilities in the form of accounts payable (money owed to suppliers) and accrued expenses (such as wages owed to employees). Accrual accounting matches the expenses to the proper time period (periodicity).

Accrual accounting is based on the matching principal which requires a company to match revenues to related expenses in the correct time period. Revenue must be recognized (recorded in the accounting record) when earned and realizable, meaning generally that services have been performed, goods have been shipped, and that payment is expected. Expenses must be recognized when incurred (take place). The actual payment of cash is recorded, but will not affect revenue or expense accounts at that time.

AccountingPlay Apps

Learn Accounting Faster and Easier

Learn financial accounting, debits & credits, and business tax easier with flashcards, mobile apps, and games. Learn accounting anytime and anywhere. AccountingPlay will help you learn in a fast and fun way. Available on iOS and Android

Premium Courses

One Time Payment. Lifetime Access.

Learn more comprehensive about debits and credits, financial accounting, excel fundamentals, business tax prep & plan, CPA tax prep, and how to start and grow your business right. Get access to all of our books, spreadsheets, academic papers, cheat sheet, audio vault, videos, and more.

Recommended Tools

One of your top priorities as a small business owner is keeping a close eye on the money you bring in and pay out, which is why it’s critical to have the right accounting software. You need a program that helps you accomplish your daily accounting tasks. Here are our best picks for tools we recommend and use