- Accounting Topic

- Financial Ratios Topic

Debits and Credits

Debits and Credits

Debits and credits form the foundation of the accounting system. The mechanics of the system must be memorized. Once understood, you will be able to properly classify and enter transactions. These entries makeup the data used to prepare financial statements such as the balance sheet and income statement.

Every accounting transaction involves at least one debit and one credit. The sum of debits and the sum of credits for each transaction and the total of all transactions are always equal. A list of all transactions appears in the general ledger. Debits are always presented before credits.

Memorize rule: Debits = Credits

Memorize rule: Debits before credits

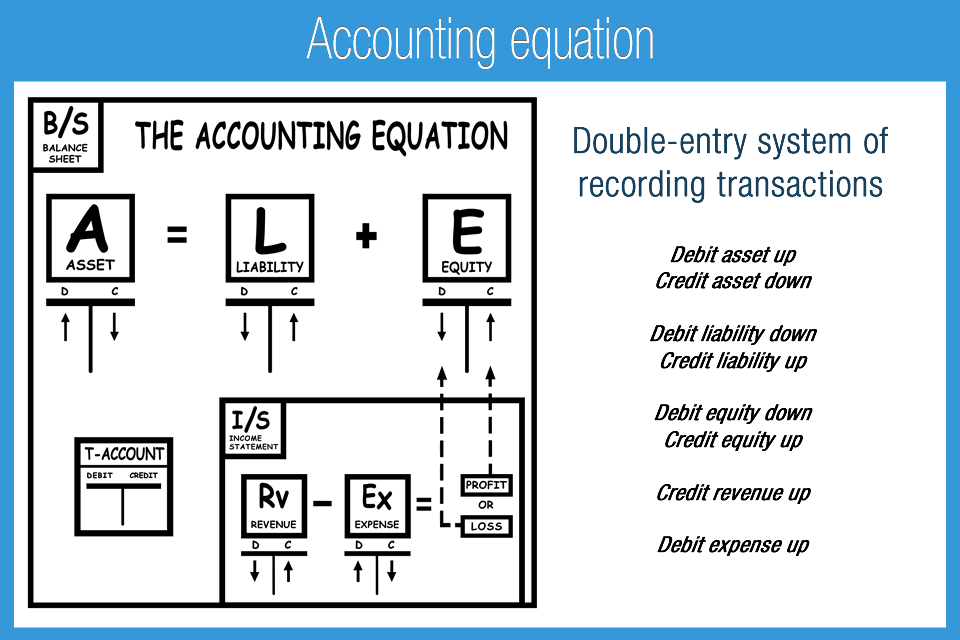

The double entry system

The process of recording transactions with debits and credits is referred to as double entry accounting because there are always at least two accounts involved. The result of using double entry accounting ensures that every transaction is classified and recorded.

The double entry system requires us to pick at least two accounts (places) to record a transaction. Let’s say a business receives $1,000 cash. To record the transaction, the cash account is increased $1,000. As a rule we need another account to record the activity. The other account will help explain the source and purpose of the transaction. Cash can come from revenue (business operations), loans, investments, or cash back from returning an item. In this example, the business was paid cash for services performed. The revenue account therefore also increases $1,000. The combined entry will be to increase cash and increase revenue for the same amount.

The double entry system is used to categorize all transactions in and out of the business. Let’s say $200 cash is paid from the bank. Cash is decreased $200 and another account is required to explain the source and purpose of the transaction. Cash is used for a variety of purposes such as: Equipment, investments, loan payments, expenses, and more. In this example, the business paid a $200 phone bill in cash. The telephone expense account therefore increases $200. The combined entry will be to increase telephone expense and reduce cash for the same amount.

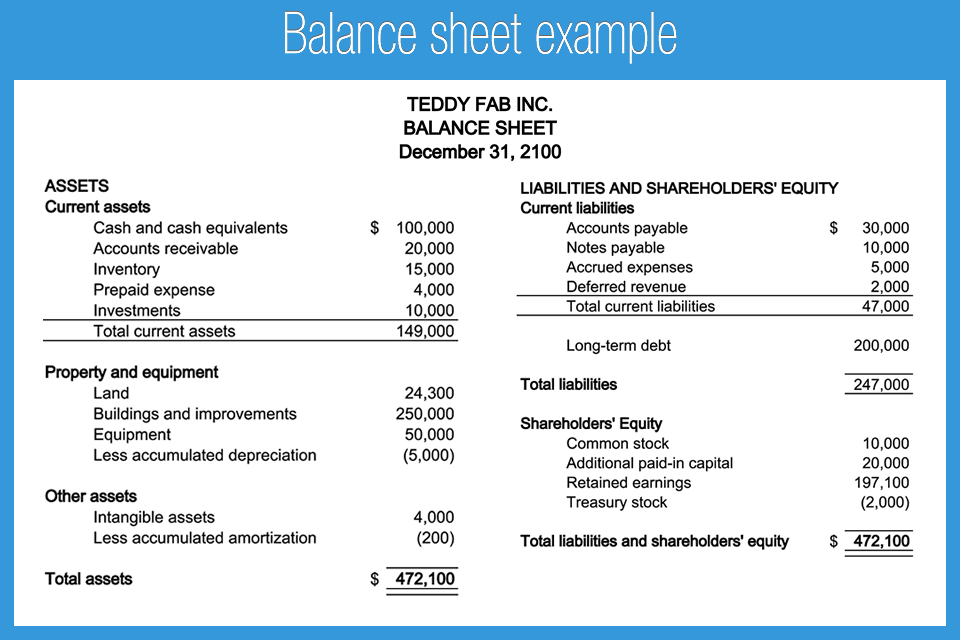

The double entry system categorizes transactions using five account types: Assets, liabilities, equity, income, and expense. The same account may also be used in a two-part transaction if there is an increase and a decrease of the same category. Assets, liabilities, and equity make up the balance sheet and form the equation: A = L + E. Revenue and expenses make up the income statement and can generally be expressed as Revenue – Expenses = Income or Loss.

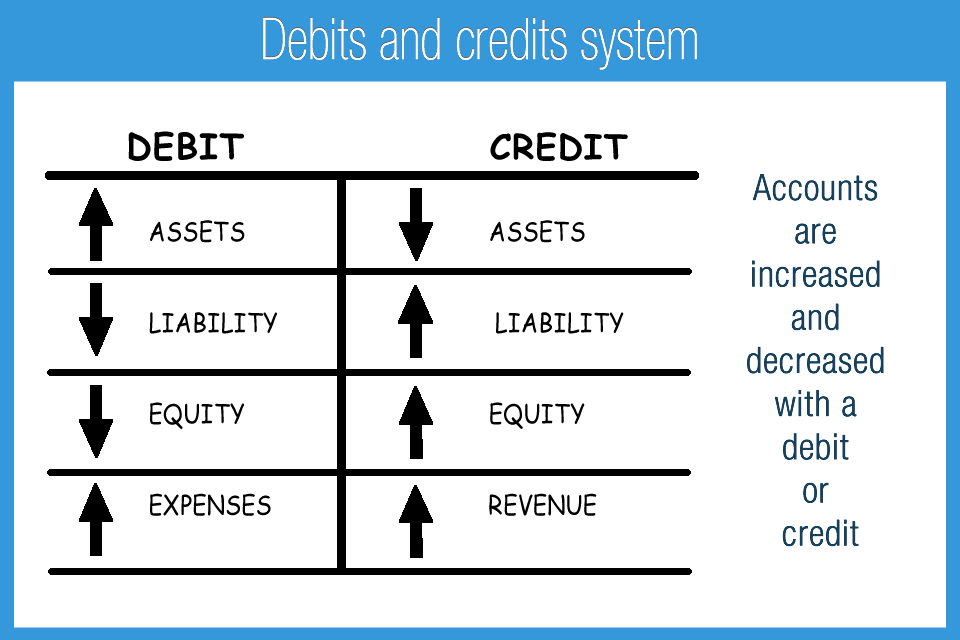

How to increase and decrease different account types

Increases and decreases of the same account type are common with assets. A business may decide to use money to buy equipment. Cash assets will decrease and equipment assets will increase. Transfers from one cash account to another are also recorded in the same category, but in separate sub-accounts.

In accounting, asset increases are recorded with a debit. Asset decreases are recorded with a credit. (Do not confuse this concept with checking accounts that use these terms differently). Asset accounts, especially cash, are constantly moving up and down with debits and credits.

Memorize rule: Debit asset up, credit asset down

In accounting, expense increases are recorded with a debit and decreases are recorded with a credit. This is the same debit and credit rule order as assets. Transactions to the expense account will be mostly debits unless there is a return of an expense or correction of an error.

Memorize rule: Debit expense up, credit expense down

Every account is classified in one of five different classifications: Assets, liabilities, equity, revenue, and expense. Each account is increased or decreased with a debit or credit depending on the classification.

Memorize rule: Debit liability down, credit liability up

Memorize rule: Debit equity down, credit equity up

Memorize rule: Debit revenue down, credit revenue up

Example accounting entries

Let’s look at how we would make the accounting entries for the following example: Receive $1,000 of revenue and pay $200 for the phone bill.

Entries:

Increase cash: Debit cash $1,000

Increase revenue: Credit revenue $1,000

Increase expense: Debit expense $200

Decrease cash: Credit cash $200

The debits and credits are totaled for each account and then canceled out. This process “nets” or “cancels” the sum of debits and credits for each account to determine the final balance. Say $1,000 of cash is received (debit asset up) and $200 was paid (credit asset down). The resulting account balance for cash will be $800: $1,000 debit – $200 credit.

Accounting is a rule-based system that requires memorization of the debits and credits system. Proper memorization and application of the basic concepts is invaluable when moving to more difficult concepts. Solid understanding of debits and credits is necessary for a student, CPA exam taker, and accounting professional.

T-Accounts

To help visually represent debit and credit entries, a T-account may be used. This is visually represented in Accounting Game – Debits and Credits as a big green T. The left side of the T-account is a debit and the right side is a credit. Actual debit and credit transactions will be recorded in the general ledger, which accumulates all of the transactions, by account. T-accounts help both students and professionals understand accounting adjustments, which are then made with journal entries.

Memorize rule: Debits on the left and credits on the right

Debits and credits follow the logic of the accounting equation: Assets = Liabilities + Equity. At all times Asset debits = Liability credits + Equity credits.

Memorize rule: Assets = Liabilities + Equity

Memorize rule: The sum of all assets will equal the sum of Liabilities + Equity

Each account type will have an ending debit balance or credit balance depending on the account type, generally speaking. Assets and expenses both increase with a debit and therefore have debit ending balances. Liabilities, equity, and revenue increase with a credit and therefore have credit ending balances. A company with a debit balance in equity, also referred to as an accumulated loss, has likely had losses at some point on the income statement.

Memorize rule: Assets and expenses increase with a debit and generally have ending debit balances

Memorize rule: Liabilities, equity, and revenue increase with a credit and generally have credit ending balances

Journal entries

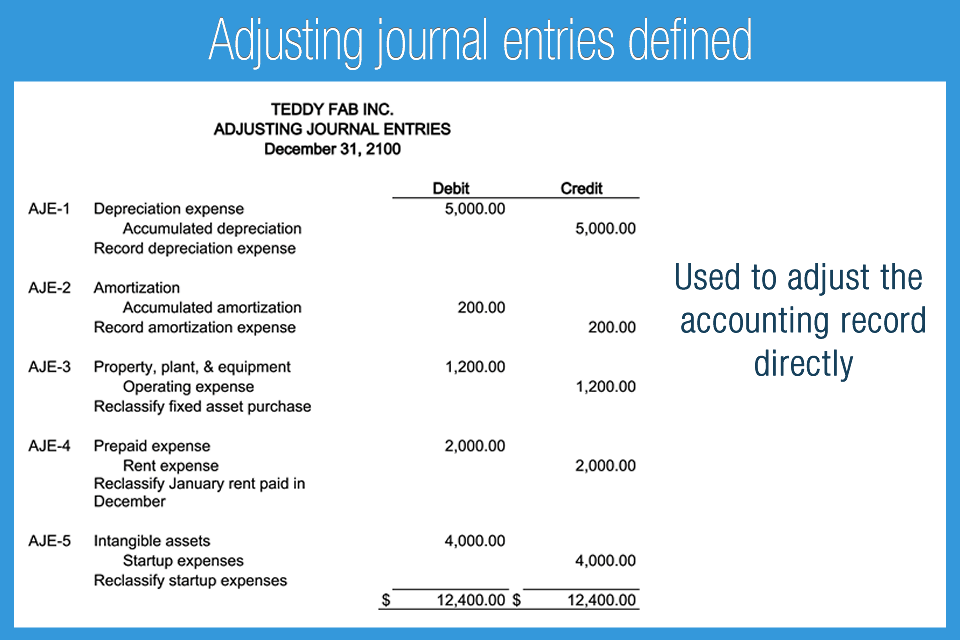

Journal entries are the mechanism of how accounting transactions are entered. Every journal entry has debits which = credits. Because accounting software replaces the need for journal entries to record transactions as they happen, adjusting journal entries are commonplace to adjust the accounting record.

Memorize rule: Journal entries first record debits then credits. Debits = credits.

Each transaction in accounting software has a debit and credit side, but the user can be unaware of this as the transaction is made most often in a graphically friendly way, such as entering a check in a register and assigning it an account. Adjusting journal entries are generally made to correct mistakes and make non-cash adjustments, such as depreciation.

Accounting Game – Debits and Credits is designed to challenge and teach common accounting transactions in a visually entertaining and engaging way. To practice T-account transactions, download Accounting Game – Debits and Credits, the free Apple App.

AccountingPlay Apps

Learn Accounting Faster and Easier

Learn financial accounting, debits & credits, and business tax easier with flashcards, mobile apps, and games. Learn accounting anytime and anywhere. AccountingPlay will help you learn in a fast and fun way. Available on iOS and Android

Premium Courses

One Time Payment. Lifetime Access.

Learn more comprehensive about debits and credits, financial accounting, excel fundamentals, business tax prep & plan, CPA tax prep, and how to start and grow your business right. Get access to all of our books, spreadsheets, academic papers, cheat sheet, audio vault, videos, and more.

Recommended Tools

One of your top priorities as a small business owner is keeping a close eye on the money you bring in and pay out, which is why it’s critical to have the right accounting software. You need a program that helps you accomplish your daily accounting tasks. Here are our best picks for tools we recommend and use