- Accounting Topic

- Financial Ratios Topic

Introduction to Accounting

Introduction to Accounting

Accounting is the system of recording financial transactions with both numbers and text in the form of financial statements. It provides an essential tool for billing customers, keeping track of assets and liabilities (debts), determining profitability, and tracking the flow of cash. The system is largely self-regulated and designed for the users of financial information, who are referred to as stakeholders: business owners, lenders, employees, managers, customers, and others. Stakeholders utilize financial statements to help make business, lending, and investment decisions.

Accounting has several specialized fields and roles. Private (internal) accounting generally refers to accountants who work within a single business entity. Small business accountants may assume general roles which require preparing the records (bookkeeping) and performing bank reconciliations. Accounting professionals are generally divided into three fields: tax, audit, and advisory. The tax field focuses on federal, state, and local tax filings. Audit roles test the validity of financial statements and internal controls. Advisory services perform general financial consulting. Public accounting firms have several different clients, whereas private accounting refers to working for one specific business entity.

Accounts

There are five different types of accounts: asset, liability, equity, revenue, and expense. Each account type includes sub-accounts to record transaction details. For example, cash assets may include several different cash and savings accounts.

- Asset accounts: Cash and cash equivalents, accounts receivable, inventory, allowance for doubtful accounts (contra account), prepaid expense, investment, property, plant, and equipment, accumulated depreciation (contra account), intangible assets, accumulated amortization (contra account) and others

- Liability accounts: Accounts payable, notes payable, accrued expenses, deferred revenue, long-term bonds payable and others

- Equity accounts: Common stock, additional paid-in capital, retained earnings, treasury stock (contra account) and others

- Expense accounts: Selling, general, and administrative, interest, repairs, depreciation (non-cash), amortization (non-cash) and others

Financial Statements

Financial statements are the end results of the completed accounting record. They include the balance sheet, income statement, statement of shareholders’ equity, statement of cash flows, and notes to the financial statements. The information provides predictive value, feedback, and timely data to stakeholders.

- The balance sheet reports business assets, liabilities, and equity up to a specific time period

- The income statement reports the profit and loss activity for a specified period of time

- The statement of shareholders’ equity reports detail of investment received and prior earnings

- The statement of cash flows reports the ins and outs of cash in three categories: Operating, investing, and financing

- The notes to the financial statements disclose information that cannot be understood with the financial statements alone

Debits and Credits

Debits and credits is the system used for recording accounting transactions. A debit or credit transaction can increase or decrease balances, depending on the account type (asset, liability, equity, revenue, and expense). This forms the basis for double entry bookkeeping which requires equal debits and credits. The underlying transactions are recorded in detail on the general ledger and are later combined to form financial statements.

- The sum of debits always equals the sum of credits

- The sum of debits and credits are represented on opposite sides of the balance sheet

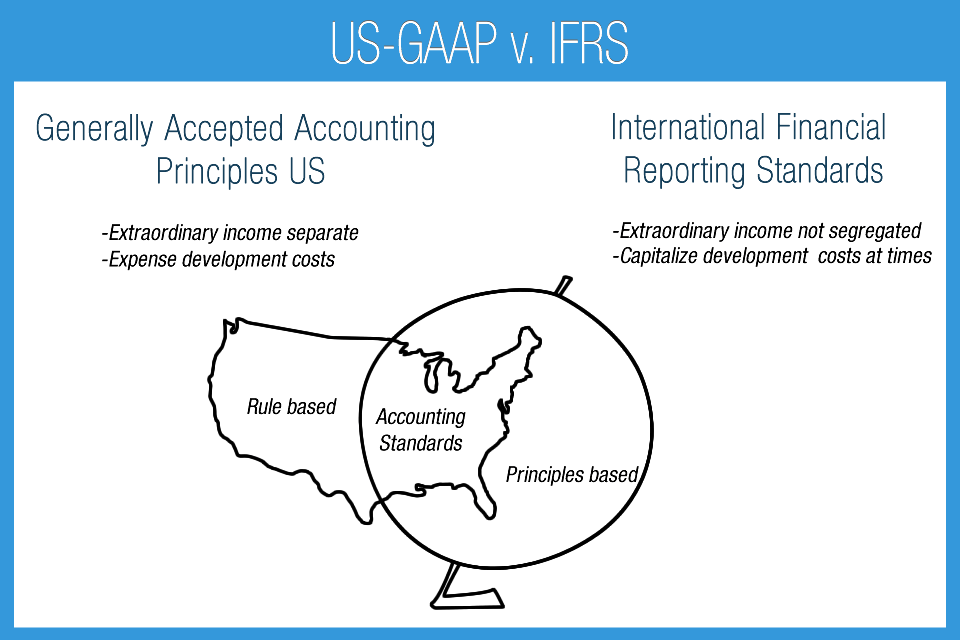

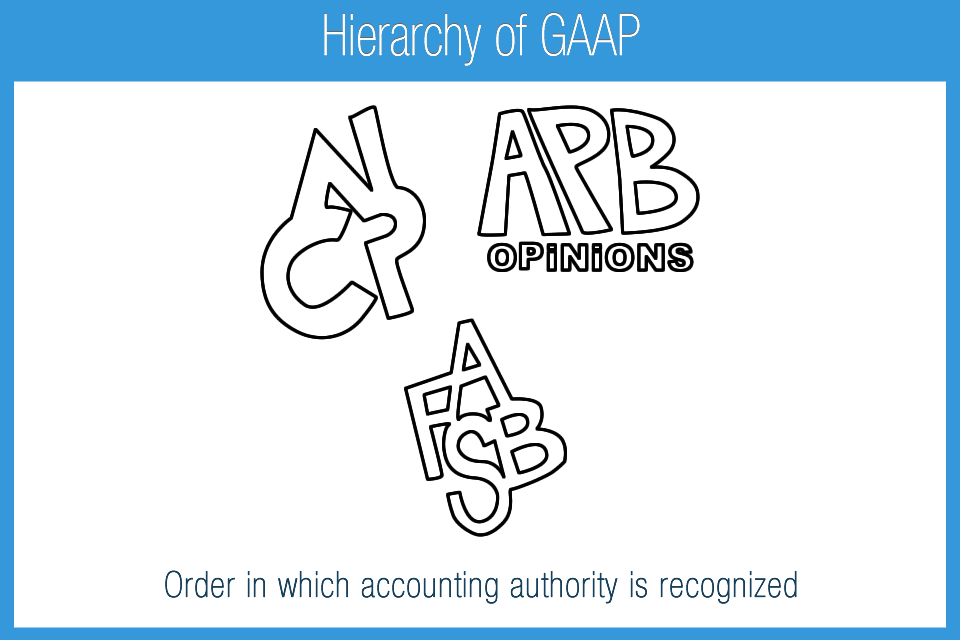

Accounting Standards

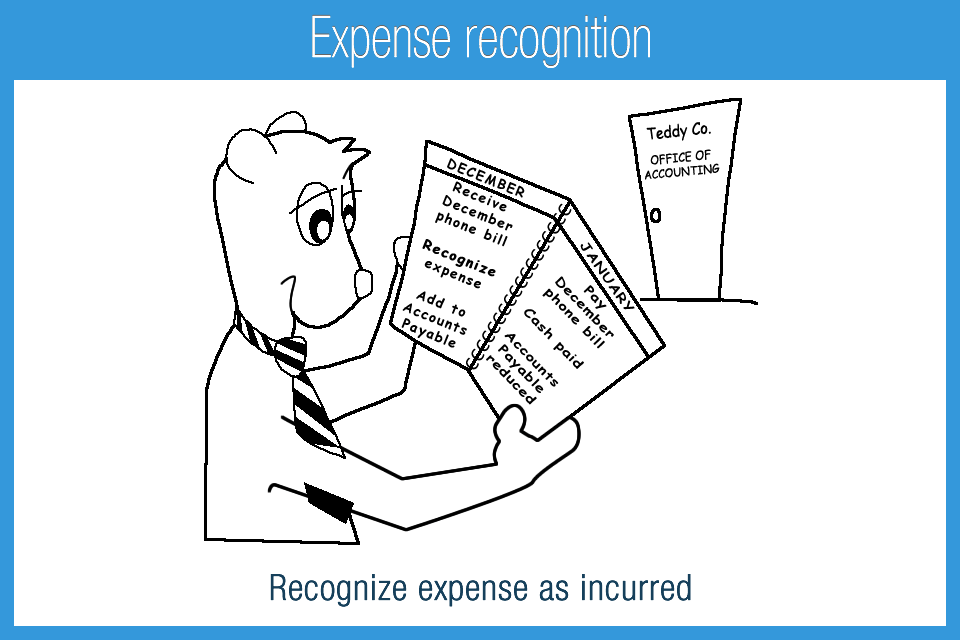

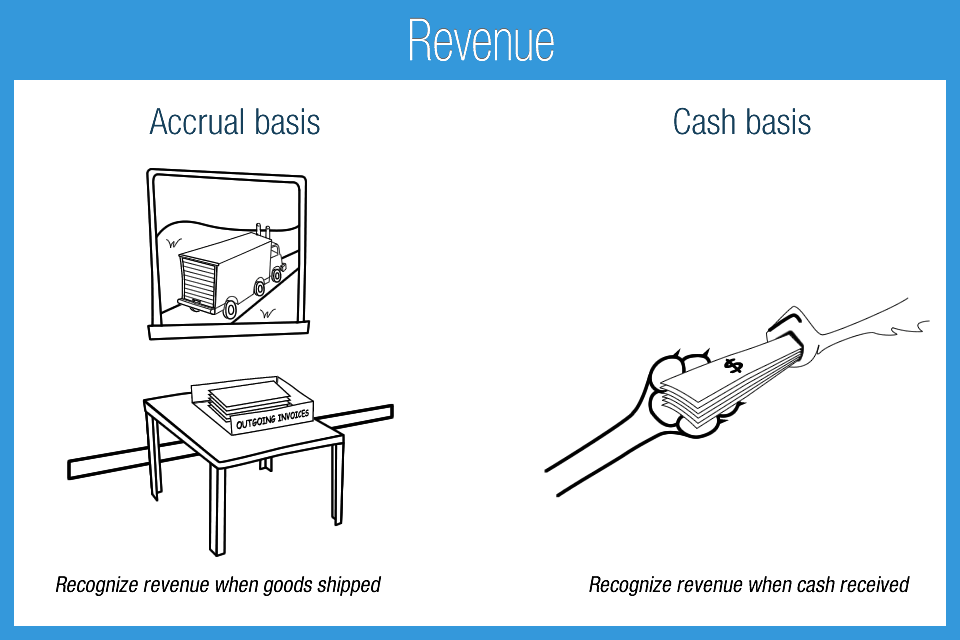

Accounting standards set guidelines and rules for financial statement preparation. These are set via a combination of private industry organizations in cooperation with government committees. Generally Accepted Accounting Practices in the United States (US GAAP) largely governs the rules for recording transactions and disclosing critical business information to stakeholders. International Financial Reporting Standards (IFRS) governs international standards. Both systems require the use of double entry accounting. While both sets of standards are similar, there are significant differences such as allowed inventory methodologies and reporting asset valuation.

Business Types and Entities

Accounting serves diverse entities such as: individuals, companies, trusts, governments, and charities. These may be legally organized in a variety of ways: corporation, limited liability company, partnerships, and others. With the exception of governmental accounting, most accounting systems follow similar double entry, accrual accounting. Financial statements may have slightly different names, depending on the entity type. An income statement may also be called a profit and loss or earnings statement. A balance sheet may be referred to as the statement of financial condition.

Managerial Accounting and Analysis

Managerial accounting is designed around the needs of managers and not necessarily regulated. It is for internal purposes and may employ any useful accounting system. Once the financial statements are compiled, the data may be analyzed using ratios and financial analysis. Accounting can provide powerful information to all stakeholders when properly maintained and interpreted.

AccountingPlay Apps

Learn Accounting Faster and Easier

Learn financial accounting, debits & credits, and business tax easier with flashcards, mobile apps, and games. Learn accounting anytime and anywhere. AccountingPlay will help you learn in a fast and fun way. Available on iOS and Android

Premium Courses

One Time Payment. Lifetime Access.

Learn more comprehensive about debits and credits, financial accounting, excel fundamentals, business tax prep & plan, CPA tax prep, and how to start and grow your business right. Get access to all of our books, spreadsheets, academic papers, cheat sheet, audio vault, videos, and more.

Recommended Tools

One of your top priorities as a small business owner is keeping a close eye on the money you bring in and pay out, which is why it’s critical to have the right accounting software. You need a program that helps you accomplish your daily accounting tasks. Here are our best picks for tools we recommend and use