- Accounting Topic

- Financial Ratios Topic

Cash Flow Ratios

Summary

Cash flow is the actual amount of cash generated or lost by an entity during the course of operations. Cash and cash flow are important mainly because it is perhaps the ultimate indicator of a company’s attractiveness, success or health. As they say, “Cash is King.”

The main reason for pursuing any business activity is ultimately to make money. Successful well-performing businesses have enough cash to comfortably make timely payments to creditors and lenders, meet operating expenses and pursue growth and expansion initiatives. Companies that are short on cash are in just the opposite position and can over time be at risk of insolvency.

Cash is a factor in evaluating solvency, liquidity, growth potential, efficiency and the quality of management overall. Understanding cash flow is so significant that financial statements usually include the statement of cash flows which is devoted entirely to this one factor. The statement is divided into three parts: operating, financing and investing.

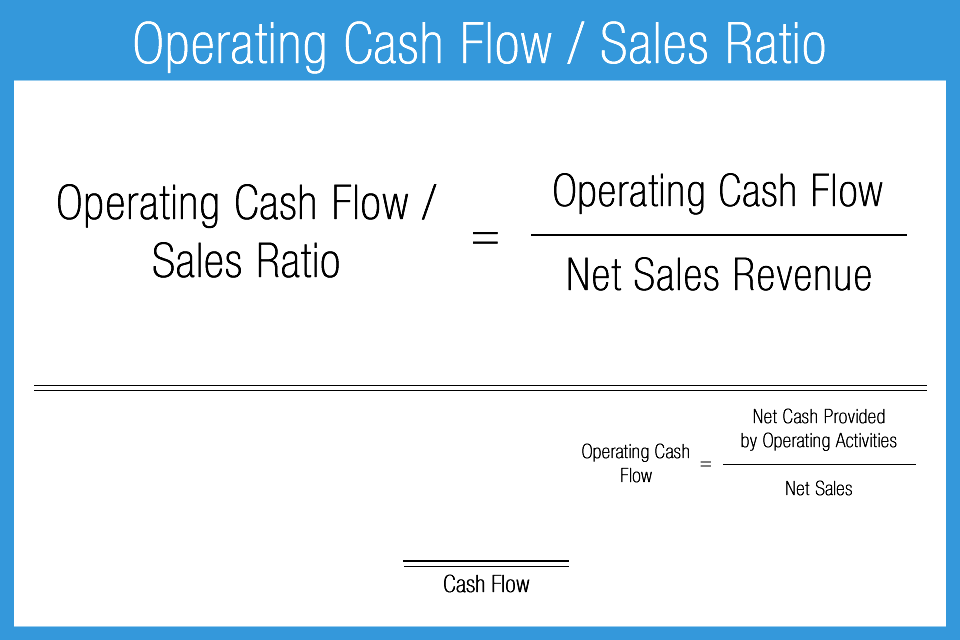

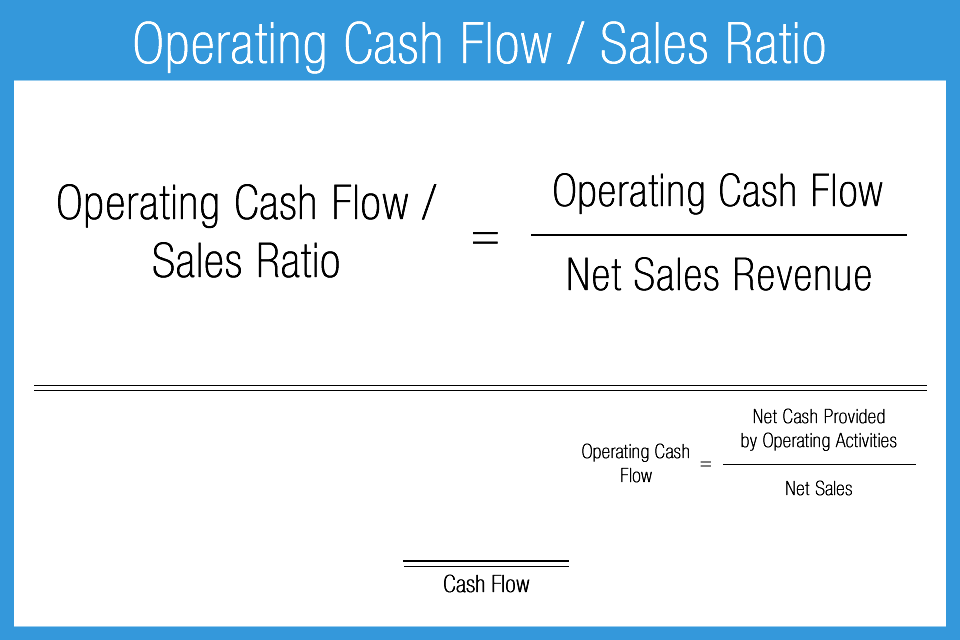

Operating Cash Flow / Sales Ratio

The operating cash flow / sales ratio is limited by its very nature. This ratio just gives a very broad or general idea about how well a company can convert sales into cash. Without a real standard benchmark to rely upon to evaluate the result, using trend analysis and peer analysis is important.

When evaluating this ratio over multiple time periods, an analyst should expect to see a reasonably consistent relationship between cash flow and sales. When sales increase, so should cash flow. If this consistency is not present, further analysis should be pursued. Some factors to look for in such a situation might include changes in sale terms, potential credit issues with buyers or issues with managing trade receivables.

- Measures the relationship of cash flow to sales

- Generally favorable: higher result

- Measure of: efficiency

- Best used with: trend analysis and peer comparison

- A broad measure only, providing no meaningful detail by itself

Free Cash-Flow / Operating Cash Ratio

Free cash-flow / operating cash flow is a significant ratio for users interested in understanding cash that may be available for additional activities. When evaluating this measure, the higher resulting ratio is better. Most credit analysts and many investment analysts consider free cash flow the most important factor to consider when making recommendations.

Good results give comfort to creditors and investors alike. High levels of free cash flow are evidence of a well performing operation and enable financial flexibility in decision making, strategic planning and the overall company management process. Peer analysis is helpful in identifying comparable standards and evaluations.

- Measures actual free cash flow in relation to total cash flow

- Generally favorable: higher result

- Measure of: liquidity, financial flexibility, and operating efficiency

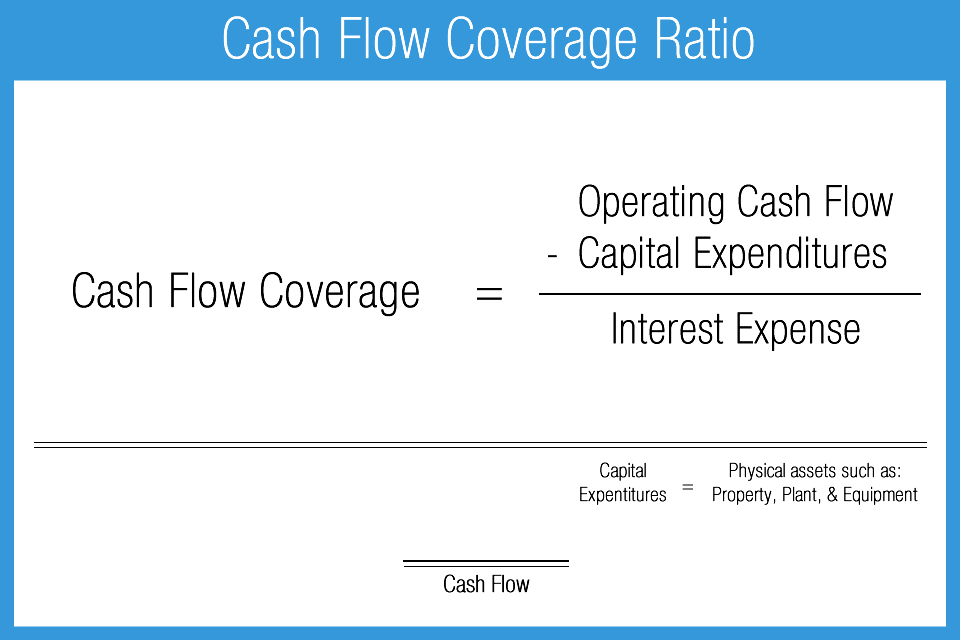

Cashflow Coverage Ratio

In its base application, the cash flow coverage ratio estimates a company’s ability to meet its interest expense with available free cash flow. The ratio is included in the cash flow group but is also a measure of liquidity or solvency. A higher result is almost always better and a comfortable minimum standard should be at least 1.5x given that other payments, not simply interest expense, can be present.

Many users place high value on this ratio, in particular lenders. It is an important indication of financial condition and company quality. Correctly evaluating the quality of cash flow coverage is critical for many reasons. Some other coverage examples include loan principal repayment, preferred stock coverage, capital expenditure coverage, dividend coverage, and other similar uses. Analysts that understand their target company, its industry and the purpose behind the analysis being conducted will find ways to best apply the concept of coverage in the course of their work.

- Measures capacity to make debt payments

- Generally favorable: higher result

- Measure of: solvency

- 1.0x is considered “break even”, 1.2x is generally considered minimally acceptable

AccountingPlay Apps

Learn Accounting Faster and Easier

Learn financial accounting, debits & credits, and business tax easier with flashcards, mobile apps, and games. Learn accounting anytime and anywhere. AccountingPlay will help you learn in a fast and fun way. Available on iOS and Android

Premium Courses

One Time Payment. Lifetime Access.

Learn more comprehensive about debits and credits, financial accounting, excel fundamentals, business tax prep & plan, CPA tax prep, and how to start and grow your business right. Get access to all of our books, spreadsheets, academic papers, cheat sheet, audio vault, videos, and more.

Recommended Tools

One of your top priorities as a small business owner is keeping a close eye on the money you bring in and pay out, which is why it’s critical to have the right accounting software. You need a program that helps you accomplish your daily accounting tasks. Here are our best picks for tools we recommend and use