- Accounting Topic

- Financial Ratios Topic

Introduction to Financial Statements

Introduction to Financial Statements

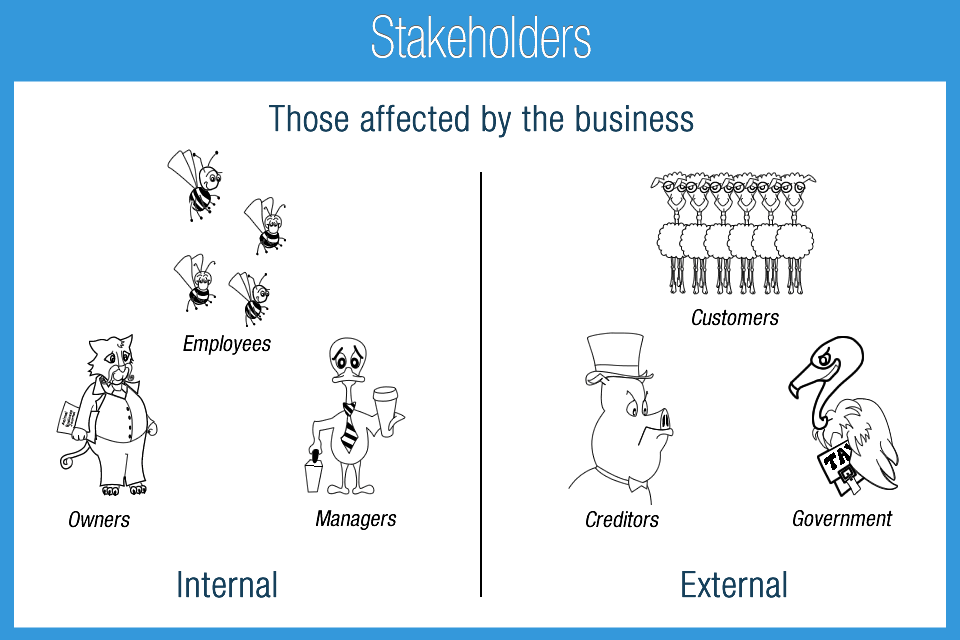

Financial statements are the final result of the accounting system. Stakeholders interpret financial statements to help make business, lending, and investment decisions. Each individual statement has an important role in helping users understand more about the reporting entity. Only when all of the individual statements and the notes to the financial statements are reported together does the user have a complete financial picture.

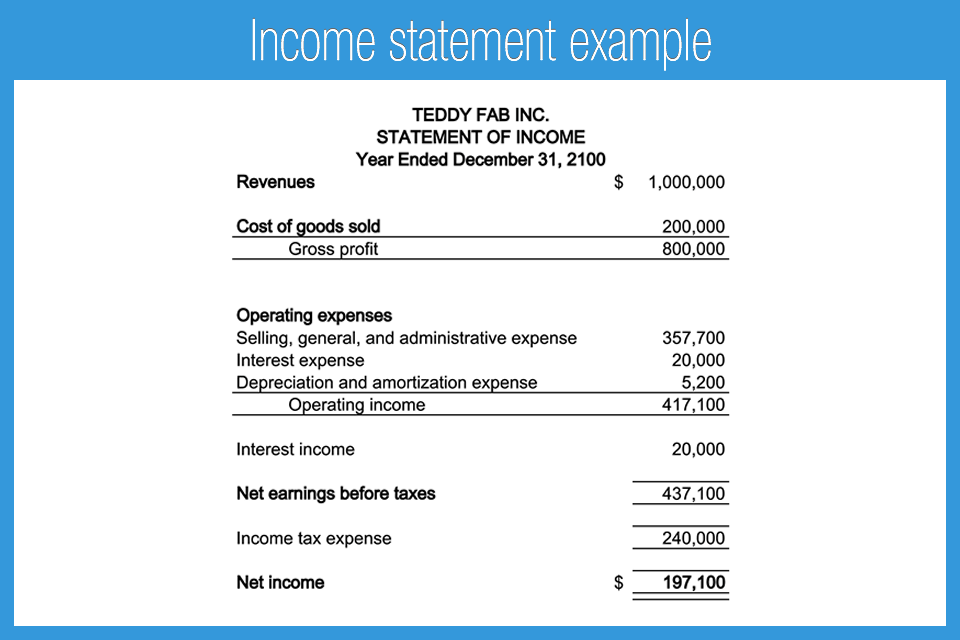

The Income Statement

Defined / Example

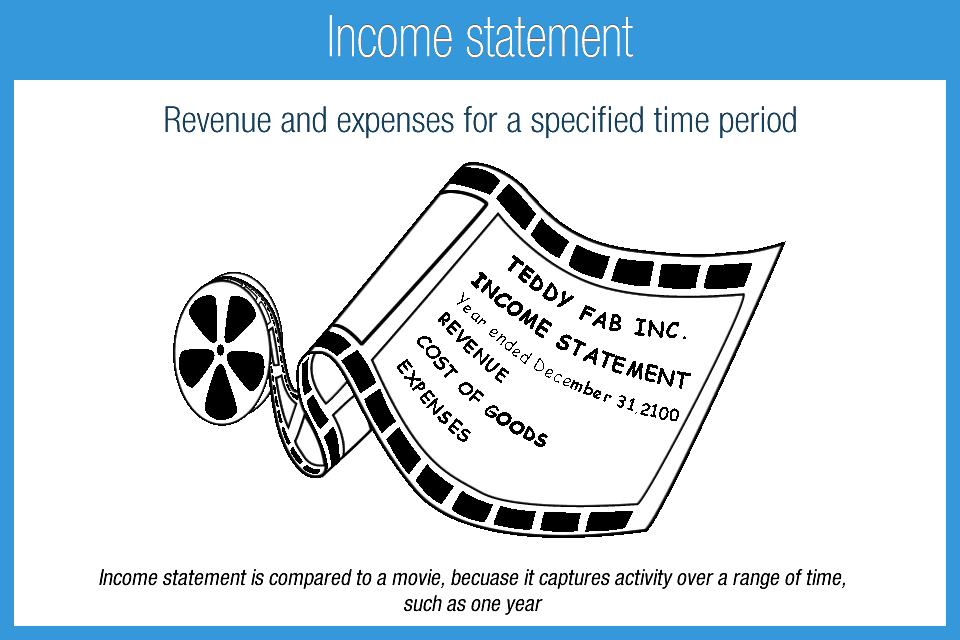

The first question a stakeholder likely has about any business is whether the business makes money or not, referred generally as profitability. If a business has a profit for a given time period, the revenue (money earned) exceeds expenses (money paid out for business and non-cash expenses). Profit or loss (also referred to as net income or net loss) is reported on the income statement for a given period of time, typically 3 months or 1 year. The ending profit or loss will be combined with prior profit and loss reporting on the balance sheet financial statement. The income statement and balance sheet are therefore related.

Depending on the business type the income statement might be called a profit and loss statement or other names. Different accounting methodologies can also produce different profit and loss results for the exact same business as long as it is reported consistently. The two general methodologies: Cash basis and accrual basis, will be covered in another lesson.

Reports the profit and loss activity for a specified period of time

- Different accounting methods produce different income statement results

- The ending profit or loss will be reported on the balance sheet.

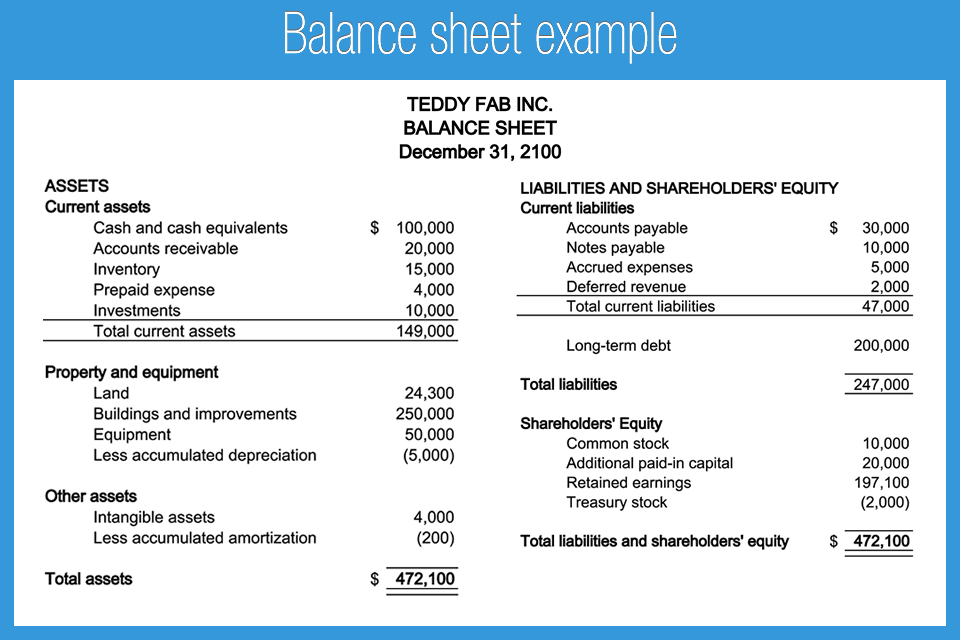

The Balance Sheet

Defined / Example

Defined / Example A stakeholder may also be interested in the assets, liabilities, prior performance, and investors a business has. The balance sheet reports this information in the form of Assets, Liabilities, and Equity. Assets include cash, accounts receivable, equipment, inventory, and more. Liabilities include accounts payable, notes payable, accrued expenses, and more. Equity includes a record of money that has been invested into the business and a record of accumulated profits and losses referred to as retained earnings. The larger the business is there are several different sections of Assets, Liabilities, and Equity, but all balance sheet items are defined in these three categories.

The balance sheet allows stakeholders critical information that cannot be found on the income statement. A business could be very profitable, but the balance sheet will give clues as to how the business became profitable. A rental building for example could show a large profit, but the balance sheet may show that there is a profit only because an investor contributed $1,000,000 cash to the business. A factory could show losses, but a look at the balance sheet could provide clues that the business owns valuable equipment, inventory, and property that could be sold at a later date. Therefore the income statement and balance sheet form a relationship together and are most valuable when viewed together.

The balance sheet also provides a check and balance to ensure that all transactions have been recorded. The financial statement is referred to as a balance sheet because Assets = Liabilities + Equity. A = L + E forms the accounting equation which also may be expressed as Equity = Assets – Liabilities. Let’s say a $1,000,000 property is purchased with $200,000 cash and $800,000 loan. The balance sheet would be expressed as: $1,000,000 Assets = $800,000 Liability + $200,000 Equity. The Equity at time of purchase roughly translates into the value that the owner has in the property. This same transaction could be expressed as $200,000 Equity = $1,000,000 Assets – $800,000 Liability.

Equity on the balance sheet is generally comprised of investment and the prior profit and loss reporting from the income statement. Let’s say a small business is started with a $50,000 investment. The $50,000 was not earned, so it would not show up on the income statement. The transaction would show up on the balance sheet as $50,000 Asset = $0 Liability + $50,000 Equity. The second major component of equity is retained earnings which tracks the profit and loss over time. Let’s say that this same business earned $10,000 for a speaking engagement and had no other expenses for the year. Now there is $60,000 cash in the bank, and $10,000 profit from revenue earned on the income statement. The $10,000 profit is added to equity at the end of the year. The balance sheet would now show $60,000 Asset = $0 Liability + $60,000 Equity ($50,000 investment + $10,000 profit)

Reports business activity up to a given period of time, usually at the quarter or year-end

- Assets = Liabilities + Equity forms the presentation of the balance sheet and the accounting equation

- The ending profit or loss will be reported on the balance sheet as a part of retained earnings

The Statement of Shareholders’ Equity

Defined / Example

Defined / Example The statement of shareholders’ equity details the transactions and activity in the equity section of the balance sheet. The change in retained earnings due to prior and current profit or loss from the income statement is reported by closing retained earnings. Large companies receive different sources of investments and are classified accordingly as common stock, additional paid-in capital, and more.

- Reports changes in retained earnings (accumulation of income statement profit and loss)

- Sources of outside investment

The Statement of Cash Flows

Defined / Example

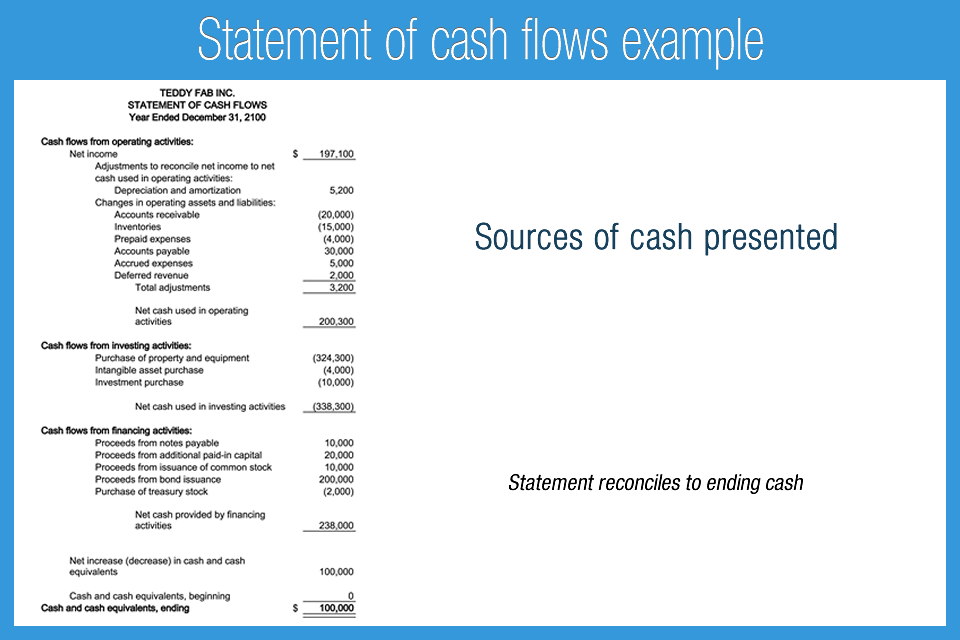

Defined / Example The statement of cash flows generally shows how cash moves in and out of the business. The statement presentation begins at the ending cash on the balance sheet of the prior period and then shows the ins and outs of cash for operations, investing, and financing activities, ending at the cash at the end of the period. Because different methods of accounting create reporting differences the statement of cash flows can be very important for stakeholders. A company, for example may report revenue for a sale made without yet collecting the cash. Typically the statement is prepared by looking at changes in the income statement and balance sheet accounts, referred to as the indirect method of preparing the statement.

- Reports the ins and outs of cash in three categories: Operations, investing, and financing

- Begins at ending cash from the prior period and ends at the ending cash for the current period

- Typically prepared using the indirect method, using the balance sheet and income statement

Notes to the Financial Statements

The notes to the financial statements provide information that the financial statements alone cannot. Notes cover a wide range of topics such as accounting methodology, balance sheet detail, and pending lawsuits. For publically traded companies, the notes may span hundreds of pages and are scrutinized by investors.

- Discloses information that cannot be understood with the financial statements alone

Financial Statement Relationships

Financial statements are most valuable when presented together. Many small businesses only prepare an income statement because they are not using double-entry accounting. In double entry accounting there is always enough information to prepare both the balance sheet and income statement as they encompass all of the accounts in the accounting system. The statement of cash flows, statement of shareholders’ equity, and notes to the financial statements provide information to support the balance sheet and income statement. The statements are designed to ultimately be useful to all of the stakeholders.

- The income statement and balance sheet report the summary of all accounts together

- The results of the income statement gets recorded into equity on the balance sheet as retained earnings

- The statement of cash flows is prepared using the changes in balance sheet and income statement activity

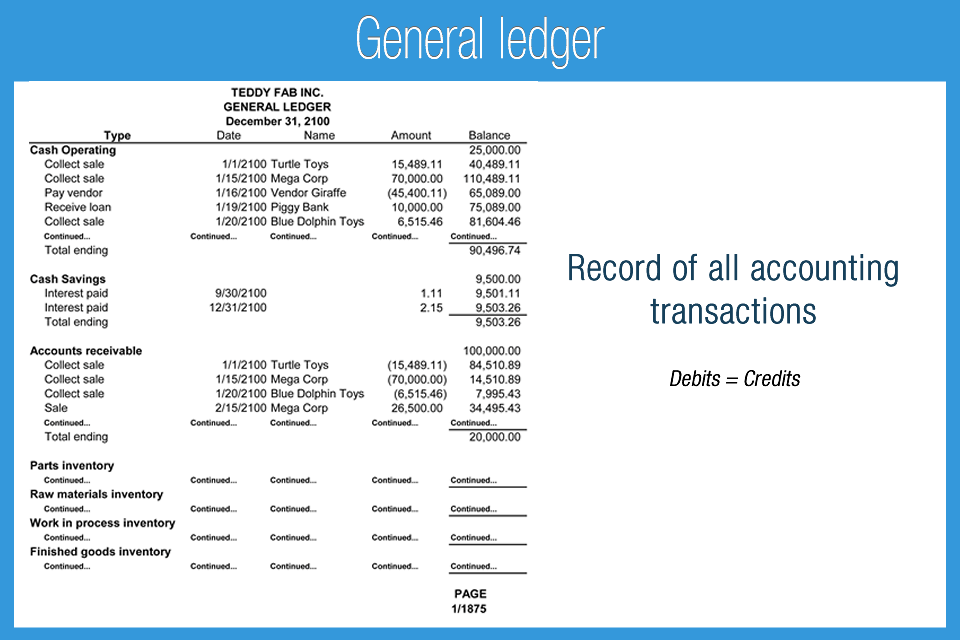

Introduction to Preparing Financial Statements

Accountants record daily transactions using accounting software which posts to the general ledger, which is a record of all the transactions. As transactions are entered into the system (general ledger) they are coded to proper accounts, such as a cash account and revenue account. The total of all these transactions are entered into a trial balance where the accountant can then make further adjustments with journal entries. Once all adjustments have been made the balances are then put into financial statements in a process known as the closing process. Note the standard order of presentation for financial statements: Balance sheet, income statement, statement of shareholders’ equity, statement of cash flows, and notes to the financial statements.

- Financial information is first entered into the general ledger

- Manual and non-cash adjustments are made using journal entries

AccountingPlay Apps

Learn Accounting Faster and Easier

Learn financial accounting, debits & credits, and business tax easier with flashcards, mobile apps, and games. Learn accounting anytime and anywhere. AccountingPlay will help you learn in a fast and fun way. Available on iOS and Android

Premium Courses

One Time Payment. Lifetime Access.

Learn more comprehensive about debits and credits, financial accounting, excel fundamentals, business tax prep & plan, CPA tax prep, and how to start and grow your business right. Get access to all of our books, spreadsheets, academic papers, cheat sheet, audio vault, videos, and more.

Recommended Tools

One of your top priorities as a small business owner is keeping a close eye on the money you bring in and pay out, which is why it’s critical to have the right accounting software. You need a program that helps you accomplish your daily accounting tasks. Here are our best picks for tools we recommend and use