- Accounting Topic

- Financial Ratios Topic

Why Use Financial Ratios

Initial Assessments

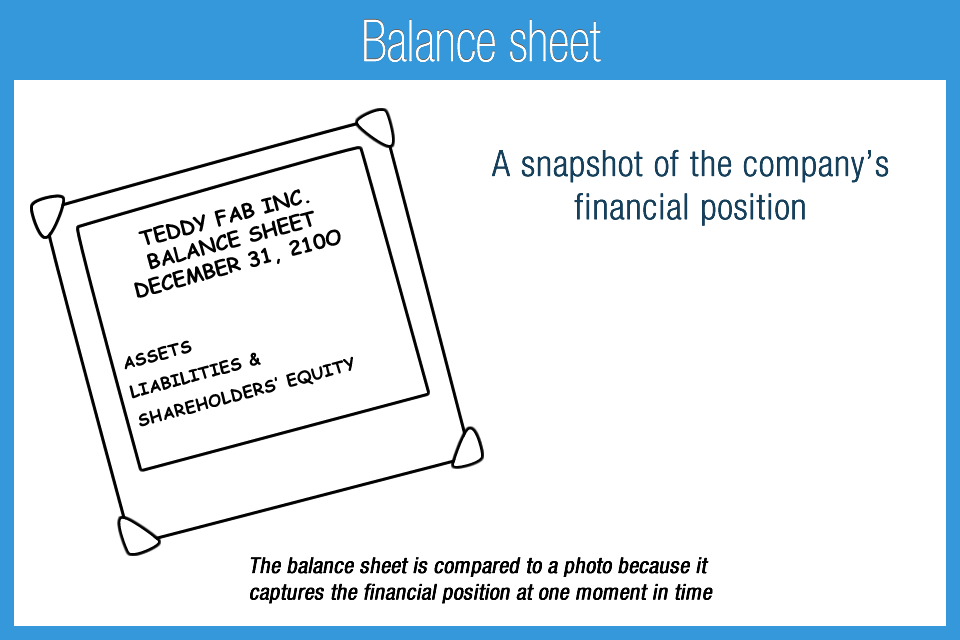

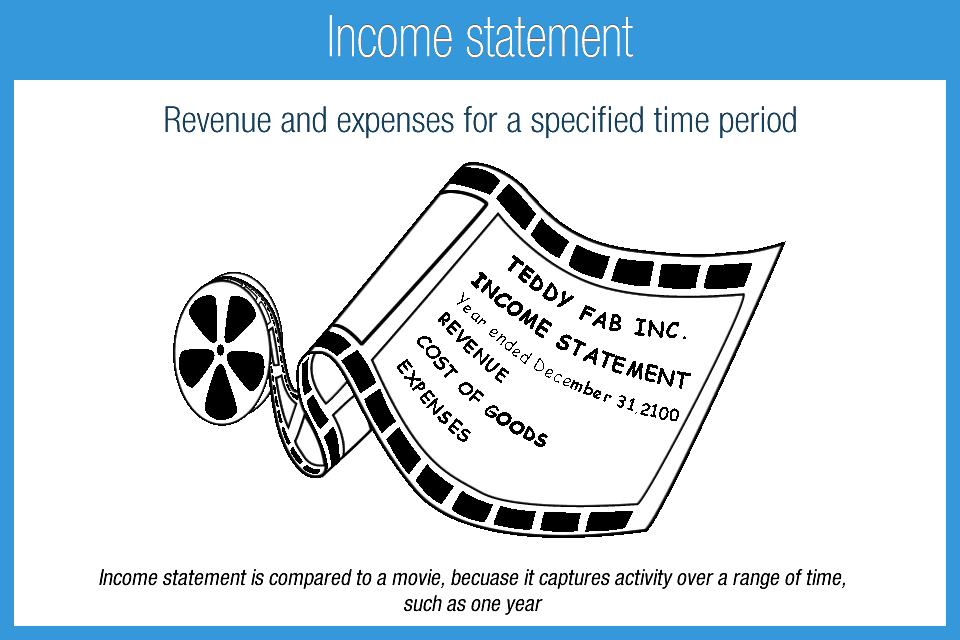

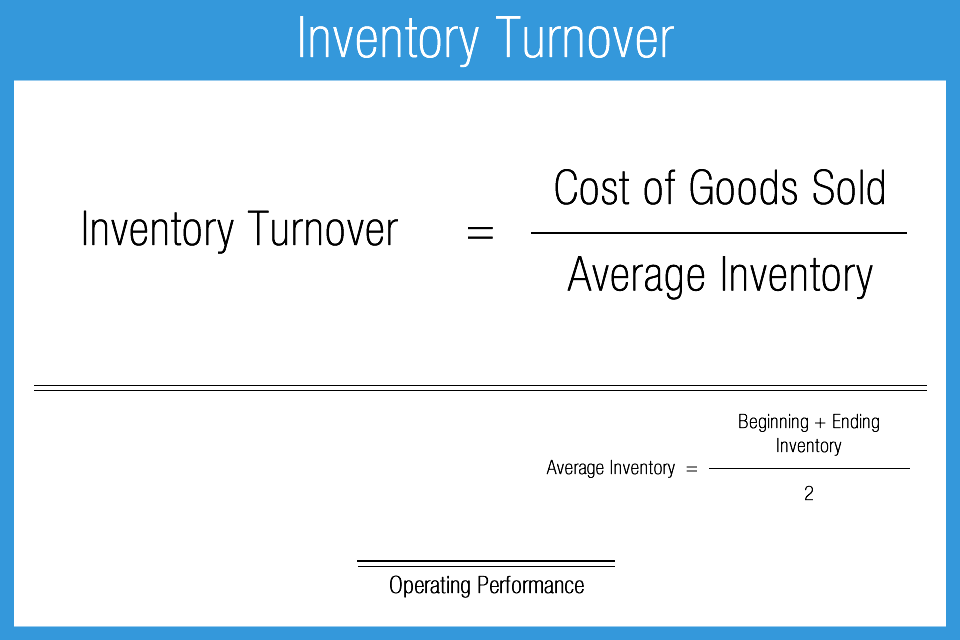

Analysts and other users employ ratios to make initial assessments and to provide a starting point for further analysis. Ratios can therefore play a supporting role in the decision making process. These initial assessments provide insight into a company’s financial condition (balance sheet information) and operating performance (income statement information), either for a single point in time or by comparing multiple reporting periods. Examples of why external stakeholders (those outside the business) use financial ratios could include investors looking for new attractive investment opportunities. Internal stakeholders such as business managers can use analysis to compare actual to budgeted results. Product or strategic planning can employ the use of these financial tools. Ratios may also be used to evaluate a company relative to competitors (peer analysis). In other words, the results provide absolute and relative information about a company.

Entity Size

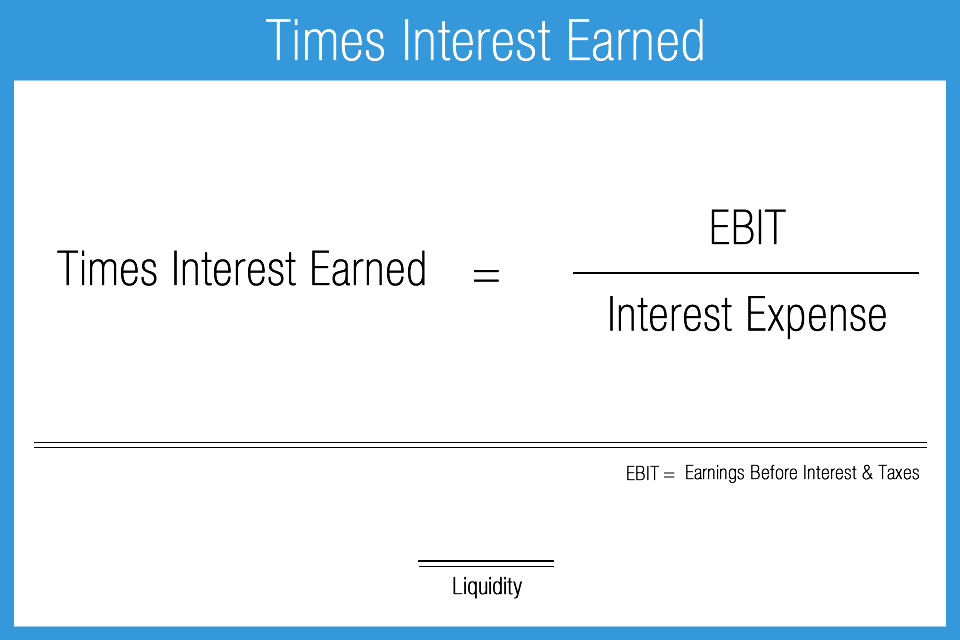

Ratios and financial analysis is typically associated with large, publically traded companies, but other entities can benefit as well. Other entities could include: small businesses, start-up businesses, municipalities, nonprofit organizations, charitable organizations, non-governmental organizations, or even a nightclub. In order to be useful, the ratios and analysis may be modified given the business size and the purpose of the analysis. Inventory turnover for example, will be a useless ratio if the company has no inventory and the times interest earned ratio won’t be relevant if a company has no debt.

AccountingPlay Apps

Learn Accounting Faster and Easier

Learn financial accounting, debits & credits, and business tax easier with flashcards, mobile apps, and games. Learn accounting anytime and anywhere. AccountingPlay will help you learn in a fast and fun way. Available on iOS and Android

Premium Courses

One Time Payment. Lifetime Access.

Learn more comprehensive about debits and credits, financial accounting, excel fundamentals, business tax prep & plan, CPA tax prep, and how to start and grow your business right. Get access to all of our books, spreadsheets, academic papers, cheat sheet, audio vault, videos, and more.

Recommended Tools

One of your top priorities as a small business owner is keeping a close eye on the money you bring in and pay out, which is why it’s critical to have the right accounting software. You need a program that helps you accomplish your daily accounting tasks. Here are our best picks for tools we recommend and use