Cuba Communist Accounting III: Taxing Casa Particulares and Cubans

Part of the Cuba Communist Accounting Series:

I Cuba Communist Economy Today

II Particular Accounting – Hot Convertibles, Top Professions, and Trickle-Around Economics

III Taxing Casa Particulares and Cubans

IV Cuba Prices from Housing to Bread to Ration Books

V Traveler Memoirs of Econ-o-Caphony, Anachronism, and What’s Good is Bad

Sections:

What is a Casa Particular

How to Book

Particular Tax System

Annual Taxes and Profits

Particular Conclusions

Intro

I was surprised the taxi made it from the Habana airport, putt, puttering now in the central city, I steal a glance at the odometer – it was long since stuck on an unimaginably high number. It was hot. I had almost a couple grand in US dollars to fund my two week New Year’s journey, as US ATM cards don’t really work, in Cuba. I had an address and the driver was asking the fifth person for what would be the final turn before arriving to my Casa Particular. The block before was bumping Afro-Cuban music, but now pure salsa blared loudly, but not so loud that I didn’t hear a rooster add to the cacophony. What was that smell? Horse poo. In the far distance two caramel tanned men were drawing the majestic animals with braided tails. We stop abruptly, breaks squealed and the engine turned off. A period of seconds and the last belch of black smoke ejected from the tail pipe – which unceremonious wafted towards my passenger side door – where the driver let me out. I could not get the ancient, rigged, handle to open. Welcome to the neighborhood.

What is a Casa Particular?

A casa particular is a Cuban family home, authorized by the government to rent rooms to foreign guests. This is a massive change from prior rules which required foreign visitors to stay in expensive, government owned hotels. By definition as of the writing, January 2017, nearly if not all “hotels” are government owned. Any business that is not government run is a “Particular” which can extend to restaurants and the like. A permit must be obtained for a casa particular, along with monthly fixed fees, as well as other taxes, which is covered later.

The casa particular is an interesting way for Cuba to meet the housing demands of tourists, support local homes, and foster an environment not dissimilar to a youth exchange. Generally breakfast is provided and there is always someone around, as it is typical that three or even four generations are living under the same roof. Hosts are generally warm, welcoming, and excited to be a part of your trip as much as you want or don’t want them around. I opted to spend a large amount of time at the home, speaking to family members regarding the state of life, economy, and future expected changes to come.

How to Book

Several different small websites, including Airbnb feature casa particulares. Expect communication to be slow, as Cubans can only

Particular Tax System

Having any type of tax system in a communism country has some inherent contradiction, as, well they are supposed to be communist. The reality of the economy is that it is trending away from state economic authoritarianism and more towards “super-subsidized socialism” ever since the fall of the USSR in the early 1990s. Most citizens from my limited interaction embrace the change, which is a welcome difference from other periods of near critical lack of resources such as food and fuel.

The tax rates on casa particulars that follow are an average that is derived from casa particular “owners.” Ownership is a recent development, where only until very recently are houses even able to be sold. The monthly fixed fee for operating such a house is approximately 50 US dollars and food sold and served in house is subject to an additional 10% tax. Owners generally take the reporting responsibilities seriously, documenting each line of every passport, noting each expenditure, and quietly calling in the occupants to a government office (at least in Havana). It is interesting to note that the taxes appear to be mostly assessed at the gross income level and do not take into account expenditures.

Annual Taxes and Profits

What follows is a synopsis of annual taxes paid by casa particular owners as explained during three interviews, with significant barriers to communication. The best answer I received as to how much the household pays in annual tax, on top of fixed monthly fees and 10% on gross food sales, is “About $200 a year.” A successful casa can bring in income in the range of almost $8,000 a year, however it is difficult to know for sure (See Part II, table, Estimated monthly average salaries). It is interesting to note that one person explained that the tax of annual earnings was based partly on how much more a household earns as compared to the average household. When I pressed for more information, he responded “no one really knows how it works.” Fair enough.

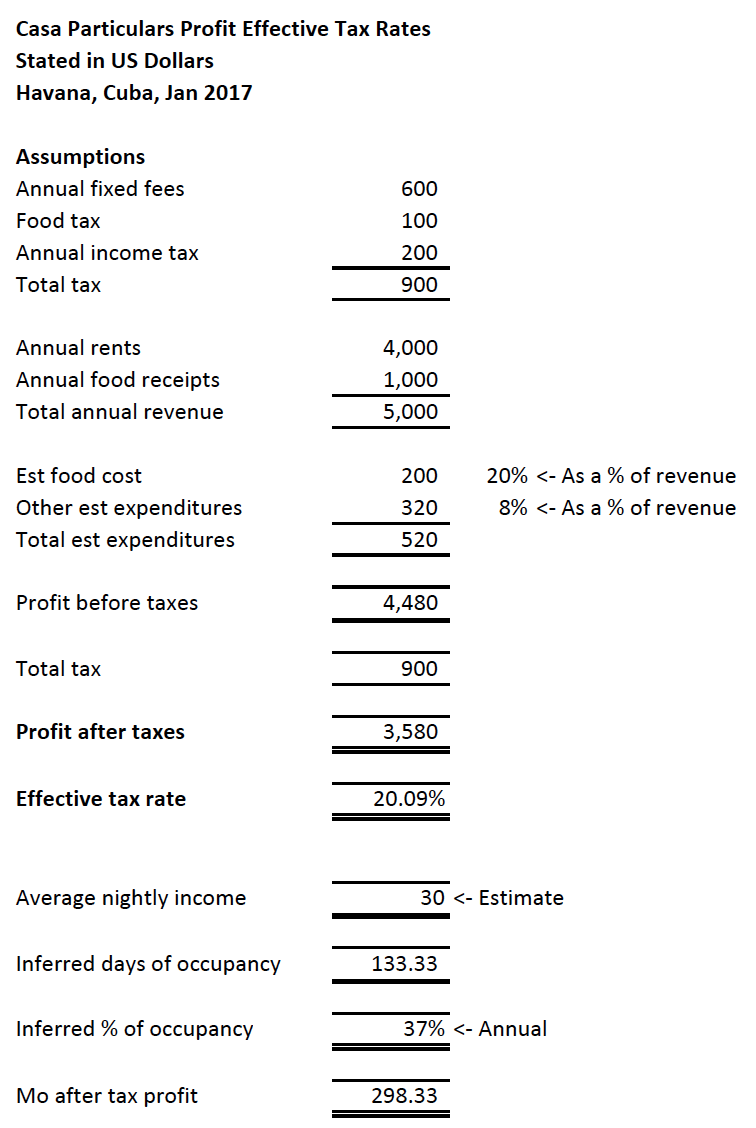

Because the taxation of casa particulares are part fixed fee, part on food income, and part on a nebulous annual year-end tax, we must make heavy assumptions to calculate a possible effective tax rate. It is important to note, that on the food cost I have a low assumed cost for mostly food, instead of lower margin alcohol. Lower margin goods with a gross receipts tax would generally increase the effective rate paid. Due to the fixed costs of the casa particular permits, effective tax will decrease with higher revenue (occupancy and food sales). My best guess at an effective tax rate for a rather average casa particular, occupied about 1/3 of the year, with some estimated expenses, is about 20%. All in all this results in an annual after tax profit of about $3,580 or about $300 a month for the family. Calculations below.

Particular Conclusions

Casa Particulares, by quantity are likely the most occurring profitable endeavor in Cuba today (see Part II Estimated monthly average salaries). Nearly all Cuban families have no rent expense and no loans unless possibly privately funded (maybe a US relative extends some help). Such earnings potential creates a massive disparity in earnings potential for those families that can obtain permits and maintain a successful operation. Such is the disparity, that a casa particular household may be earning in the range of fifteen times that of another average household. This gap in wages is sure to spur economic growth and be highly disruptive to the economic and social - socialist, fabric.

Leave A Comment