Podcast: Play in new window | Download

Subscribe: Apple Podcasts | RSS

What can businesses write off to save on taxes?

A tax write off is something that reduces the taxable profit for a business and therefore decreases taxes due. Profit in a simple business can be thought of the money or assets available to pay the owner at a point in time shown on the profit and loss. Exact definitions can get quite technical, but let’s get right to a profitable example and see how deductions work.

Example Profit for a Consulting business:

Revenue (cash collected from clients for work): $10,000

Rent expense or write off (cash paid for rent): $1,000

Profit: $9,000

Income tax will be applied against the profit: Revenue $10,000 – Write off $1,000 = $9,000 profit.

The primary example above forms a miniature profit and loss financial statement.

Revenue (cash collected from clients for work): $10,000

Rent expense or write off (cash paid for rent): $1,000

Profit: $9,000

A completely free PDF IRS guide attempts to explain being self-employed and what small businesses can deduct here.

Intro to Tax Deductions

These business tax deductions reduce the amount of tax due and are therefore valid write offs.

Having business expenses reduces taxes, but money spent is money gone. Do carefully spend money so that it will grow your business long term and the profit short term.

Paying more for extremely fast internet for example may be a nice and allowable deduction that reduces taxes, but may not improve productivity more than the standard connection. Money spent simply to reduce taxes is still money gone and likely not a good business strategy.

Let’s explore common deductions that can help reduce tax, utilize assets, grow revenue, increase productivity, and add to profitability. Even creating a more pleasant work environment is a perfectly valid reason to spend. Think about business owner happiness and how employee retention can increase money in the bank.

22 Common Business Write Offs for Small Business Owners

| 1. Internet, Connectivity, Hosting, & Phone | If there is a significant personal use, then a portion may be non-deductible. |

| 2. Accounting, Tax Prep, & Professional Services | Outside services are standard deductions. |

| 3. General Contractors & Employees | General contractors are a frequent tax deduction, so long as their efforts are not directly connected to inventory assets. Employees are common expenses including associated payroll taxes. The cost of employees manufacturing goods could become a part of the good as an asset until sold. Be sure to issue 1099-Misc to individual contractors and W-2s to employees. |

| 4. Interest & Bank Fees | Can be deducted with a business use. Interested attributed or traced to non-business use would not be a valid business write off. |

| 5. Advertising & Marketing | Flyers, business cards, and promotions. Google, Facebook, and other ads. Websites, writers, podcast, and paid press releases. |

| 6. Software & Subscriptions | SAAS, email service, and hosting. Professional memberships, associations, and trade publications. |

| 7. Small Electronics | Single items can typically be expensed when an election is in place to write off $2,500 or less at a time. Examples can be computers, tablets, monitors, and phones. |

| 8. Liability Insurance | Liability Insurance is an important business expense even if a corporation or limited liability company is in place. Other insurance such as health insurance and limited life insurance have specific rules and are not always easily deductible. |

| 9. Shipping to Customers | Shipping out to customers. Shipping in of goods required to manufacture a product may become a part of the product cost. |

| 10. Depreciation & Amortization | Physical assets such as buildings, improvements, and machines may be required to be written off over time instead of all at once. Intangible items such as goodwill and purchased patents may be amortized as a way to write the item off over a period of time. |

Write Offs 11 to 22 Proceed with Extra Caution

| 11. Pension & Profit Sharing Plans | A great way to defer taxable income on current earnings and earnings on the investments Such plans can be subject to a lot of rules and compliance. |

| 12. Computers | To write off larger items, the taxpayer may need to depreciate them overtime or follow unique protocols to deduct all in one year. Deduction all in one year instead of overtime can be referred to as using Section 179. |

| 13. Supplies | Would be deducted as they are actually used, or else they could be considered a business asset until consumed. |

| 14. Utilities | Utilities such as power for the office is deductible, but utilities for product manufacture could become a cost of the product deducted when the product is sold. |

| 15. Manufacturing Prototypes | Prototypes could likely be expensed, but if they are an asset to the business the cost would not we a write off until sold. |

| 16. Laundry & Cleaning | Business clothing that is not ordinarily acceptable for public use, such as a chef’s uniform. Suits, dresses, and anything suitable for ordinary personal use would not be deductible. |

| 17. Cost of Goods Sold | The cost of an item becomes a write off once it has been sold. Purchasing inventory does not create an expense until the asset (inventory) is sold. |

| 18. Parking | Ordinary parking is deductible. Extremely costly parking could have limitations. |

| 19. Repairs | Repairs are a common ordinary and necessary business expense. If the cost is an improvement, then this adds to a depreciable asset value that is written off over time |

| 20. Health Insurance | Health insurance is often a deduction but can have limits as to how much, when, and where this becomes a write off. |

| 21. Vehicles | Vehicles often create deductions via standard mileage or actual expense assuming no luxury vehicle limits apply. A commute by default is not deductible. |

| 22. Home Office | Must be a regular and exclusive use. Must be the principal place of your business. 35 pages of home office details by the IRS, PUB 587. |

It is also important to note that it is possible to divide certain expenses, such as your phone bill, into a personal and business portion on your taxes. You may for example have your $100 a month phone bill go through the business account and later allocate a portion, say $30 a month to personal and $70 to business.

Would you like to see an extensive list of common write off ideas?

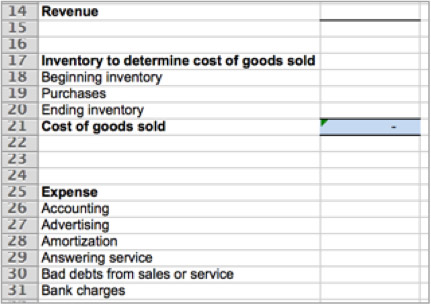

Find this excel profit and loss example on my CPA firm downloads page.

5 Limited, Complicated, & Sometimes Disallowed Deductions

Deductible meals are only allowed a 50% deduction of the meal cost

Solo meals by the business owner while in town would not be a write off

Meals while traveling, even if by yourself, create a 50% deduction of the meal cost.

A per-dium cost depending on the travel area may result in a better tax deduction.

Employer-provided meals are also subject to a 50% limitation and other rules for any of it to be a valid deduction.

Generally, gifts of $25 or less are considered tax-deductible.

Larger gifts would likely not be deductible unless it is a form of compensation and proper tax documents are issued to the recipient (such as a 1099-Misc or W-2).

Luxury vehicles are limited.

10 Common non-deductible expenses for small business owners:

A company can still contribute to political campaigns and lobbying; however, this would be a non-deductible business expense.

Politicians and parties are not non-profits.

Gym, tan, and even laundry can be offered as an employee benefit, but this cost is mainly non-deductible.

Employees may impute income for a gym benefit, meaning, they are taxed on certain benefits.

Clothing acceptable for ordinary wear is not deductible, and neither is the cleaning of such clothing.

While the club can offer a business opportunity, it does not offer a full business write-off.

Note that food and drink consumed could potentially provide a write-off limited to 50% of that cost.

Business time spent on a business is not a write off (wages paid are deductible).

Payroll and cash paid to others could be deductible.

Penalties are non-deductible expenses.

Interest paid on past due business tax obligations could be a deduction.

Illegal activities, including bribes in the course of business are not deductible.

Entertainment such as sporting events and concerts are no longer deductible.

Note that food and drink consumed could potentially provide a write-off limited to 50% of that cost.

Things like antiques and fine art are not deductible, as the value of these items are not expected to decline.

Fed taxes paid do not become a tax deduction.

State taxes paid could be deducted on a federal tax return.

This post is brought to you by the Write Off – the App that teaches you business tax deductions, structure, and even accounting with an easy game. Explore the game, expert info, videos, tips, audio, and more for business owners.

Excellent information, thank you!