“Please let me know if you ever have any suggestions as I begin studying for the CPA”

-Big 4 CPA Candidate

CPA Exam Tips

Intro

The CPA exam is not extremely difficult by itself, but is very demanding in terms of time and planning. Would you fail a test if given all of the answers ahead of time? I hope the answer is no. If you have the proper review materials, you will have ample prior exams and instruction. Success on the exam is mostly based upon the level of personal commitment in terms of quality time spent studying and planning.

My Success

I passed all of my exams on the first attempt. I saw coworkers far more advanced in their careers hung up on the exam, letting sections expire, and experiencing untold, horribly negative feelings. My solution was to dedicate everything to the exam for one full year, taking one section at a time, studying an average of two hours a day – every day. Hours were tracked daily. This study overkill approach practically guaranteed my success and long-term knowledge retention. I took the most difficult section of the exam first and coordinated the study period when work was the slowest. I used the best resource that worked for me, Roger CPA: Sale! $200 Off

(By clicking the think above you can help support Accounting Play if you purchase the Roger course in the next 30 days)

My Dirty Secrets

I had the time to over prepare for the exams and took unpaid days off to study, rest up, and travel to testing centers. Before bed, on the way to work, and on the treadmill - I would listen to audio lessons. I was also taking masters in accountancy courses and took my audit exam at the same time I had just finished the audit class. I completed every question in every book at least twice. I also worked in a small firm where I was exposed to both the audit and tax side so things were familiar. Money was no object: Hours at cafes, best review materials, and time off of work. Everyone will have their own opportunities and you must take advantage of what you have and be brutally realistic of what you don’t.

Planning One Year in Advance

Simply qualifying to sit for the CPA exam is a daunting task. If you took days figuring out your major classes and talking to college counselors, this exam is even worse. You will be bombarded with so many deadlines and requirements that you will wonder if just taking the exam is part of the certification process. Plan the exact dates one year ahead and a contingency plan if you don’t pass the first time around. Whether it was the ethics exam or Board of Accountancy submission, I had every step of the way planned out and ready. Upon each score I would know the next step and promptly begin studying.

Save up and take the hardest section first

Save up your money, time, and relationships for what will be a long year of studying. It is not the content that hurts the most – it is the sacrifice of giving up vacation time, family, and passions to study for a costly exam. But I would rather get it all done at once. I suggest saving up, planning it out, and making your commitment. Passing the easy test first and dipping your toes in the water is a dubious strategy as exam sections expire.

What about content?

Oh yes and the CPA exam tests technical content. But you are more than smart enough for that. The review courses and books give you all the answers. It is a factor of time commitment, using quality study practices, and materials.

Vision

Get clear on your vision as to why you are putting yourself through all of this to become a Certified Public Accountant. Draw on paper all of the benefits and revisit it often when you doubt yourself. This process can hurt a lot of things such as your: back, relationships, eyes, and head. Please explain to your loved ones what you are doing and ask for their support. When it is all over and your vision was pure, you will have an incredible accomplishment.

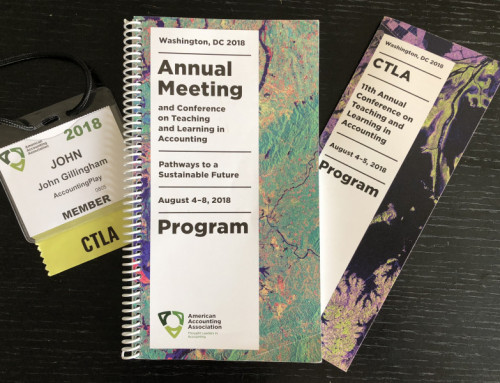

-John Gillingham CPA

Vision Epilogue – 4 Years Post CPA Exam

My vision was to help family and friends with their financial needs – at home and in my board shorts. The board short thing has worked out great, as I am self-employed and loving it. I get great satisfaction in creating educational resources and helping my clients. I no longer work for family as I want to spend other quality time with them, not financial time. Both my CPA firm Gillingham CPA and educational business, Accounting Play are helping others on a daily basis. Life is good.

Some of the accounting questions and answer don’t add up. I went through some of ir and at times its confusing, thats why you are getting those feed back. When i finish the rest of it i will let you know which ones are confusing. Its good dont get me wron

I iz a bits confuzed what is you saying?